LHDN Employer Responsibilities and Tax Compliance Procedures in Malaysia | July 2024

(Join our Community Series: Mastering Statutory Contributions and Employee Benefits 21 August 2024 with LHDN Officer (Physical Event). Details at the end of this article.

In July 2024, the Lembaga Hasil Dalam Negeri Malaysia (LHDN) emphasized the importance of employer compliance with tax regulations. These updates focus on simplifying the tax processes and introducing mandatory electronic services to streamline employer obligations. Staying informed about these changes and adhering to the new guidelines is essential for avoiding penalties and ensuring smooth tax operations.

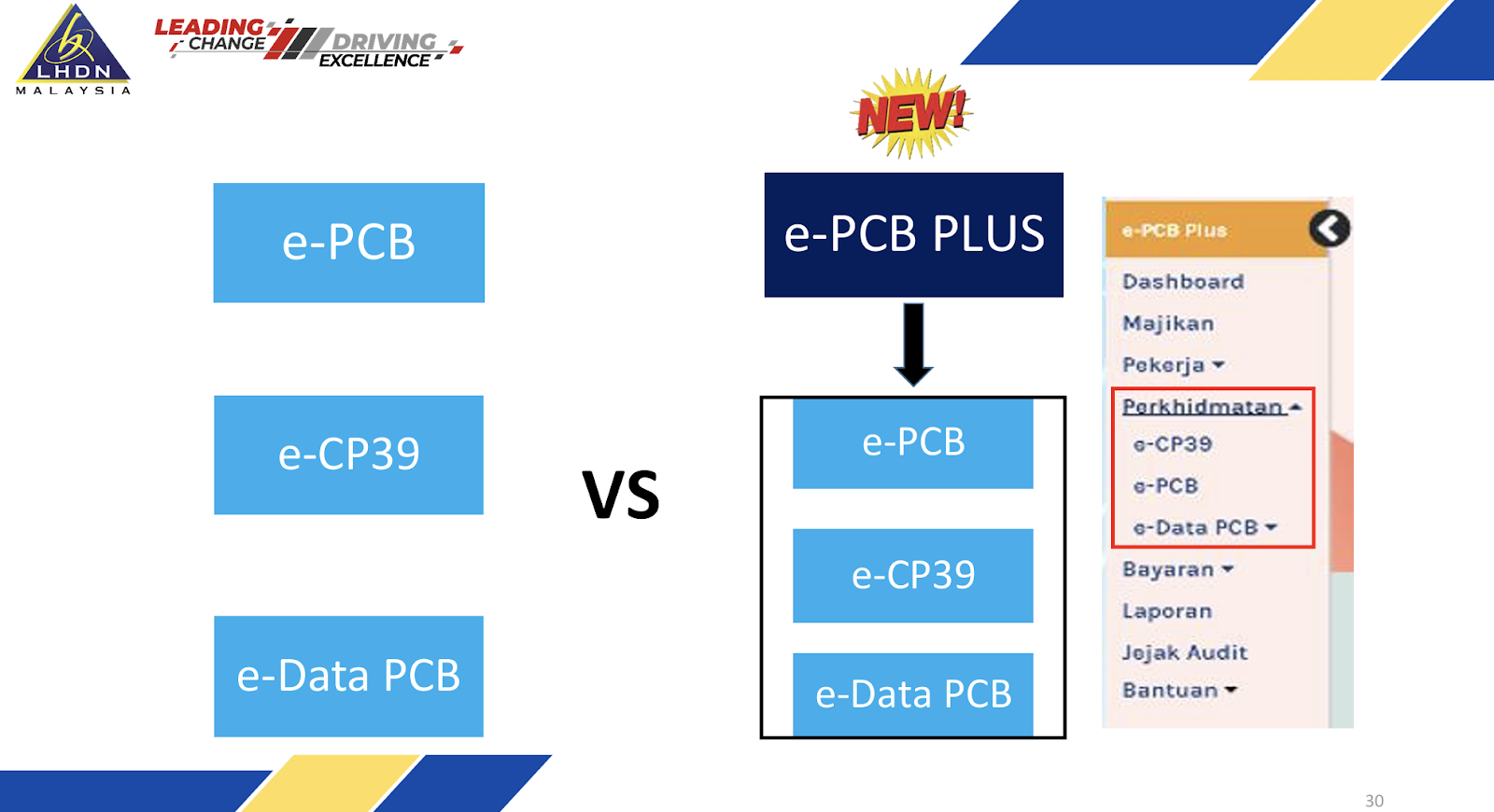

Elements of e-PCB Plus

Definitions

Majikan (Employer): An individual or entity responsible for paying wages to employees, including business owners, primary partners, appointed representatives, and key management personnel.

Pekerja (Employee): An individual under the service of an employer, either as a servant or holding a position that entails employment responsibilities.

What are the Roles of Employers

Employers play a pivotal role in ensuring tax compliance for their employees. Their responsibilities include:

- Assisting LHDN in tax compliance and collection.

- Providing necessary facilities and support to employees for tax payments.

Responsible Officers

Responsible officers within an organization include:

- Individuals: Business owners, primary partners, and appointed representatives.

- Groups (Section 75(1)(b)): Managers, chairpersons, department heads, treasurers, secretaries, and committee members.

- Companies (Section 75(1)(a)): Main management or officers in Malaysia, directors, secretaries, or anyone performing similar functions.

Employer Responsibilities Roadmap

- Registration of Employer Tax Identification Number (TIN) - CP600E:

- Employers must register with LHDN to obtain a TIN. This registration can be done online through the MyTax portal.

- Monthly Tax Deductions and Remittance - PCB/CP38:

- Employers are required to make monthly tax deductions from employees' salaries based on the PCB schedule or computerized calculation methods. The deducted amount must be remitted to LHDN before or on the 15th of the following month using applications like e-PCB, e-Data PCB, or e-CP39.

- Notification of New Employees - CP22:

- Employers must report new employees who are liable to be taxed within 30 days of their employment start date. This notification can be submitted electronically via the MyTax portal starting from July 1, 2024.

- End of Employment Notifications - CP22A/CP22B:

- Employers must notify LHDN when an employee leaves, retires, or passes away. This includes withholding any payable amounts to the employee for up to 90 days until receiving clearance from LHDN.

- Notification of Employees Leaving Malaysia - CP21:

- Employers must inform LHDN if an employee is leaving Malaysia for more than three months.

- Preparation and Delivery of EA/EC Statements:

- Employers need to prepare and deliver EA/EC statements to their employees by the end of February each year. This statement summarizes the employee's earnings and tax deductions for the year.

- Submission of Employee Remuneration Data - e-Data Praisi / e-CP8D:

- Submit remuneration data of employees to LHDN between January 1 and February 25.

- Record Keeping:

- Employers must maintain all tax-related records for seven years to ensure compliance and facilitate any future audits.

MyTax Management

Employers and their representatives can manage tax-related activities through the MyTax portal. The process involves:

- Logging into MyTax.

- Submitting necessary tax forms and documentation.

- Updating employee and employer information as required.

Monthly Tax Deduction (PCB) Management

Section 107(2) ITA 1967: Employers must make monthly tax deductions to avoid employees being overburdened with lump-sum payments.

- PCB / CP39: Regular deductions from employees' salaries.

- CP38: Additional instructions from LHDN for tax arrears.

Types of Employee Remuneration for PCB Calculation

Regular Remuneration: Includes salary, overtime, tips, commissions, director fees, and other regular payments.

Additional Remuneration: Includes bonuses, stock options, employer-paid taxes, severance pay, and other additional payments.

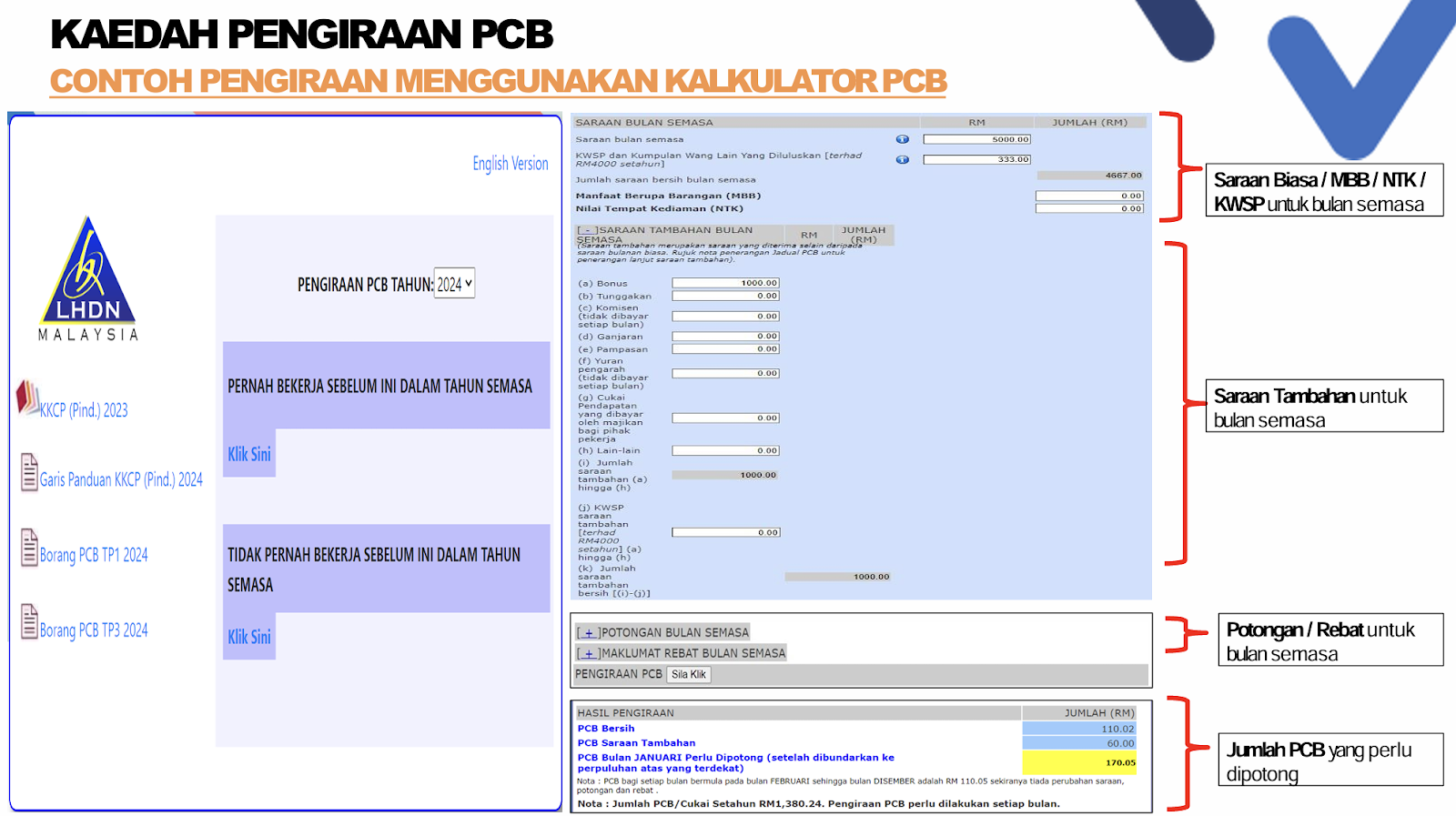

Calculation Methods for PCB

The calculation of Monthly Tax Deductions (PCB) can be done using either computerized systems or the e-Jadual PCB provided by LHDN. Here are the details:

- Computerized Calculation:

Calculator PCB Guideline

- Employers can use systems or applications developed by LHDN such as e-PCB, e-CP39, and Kalkulator PCB.

- Alternatively, employers using payroll systems provided by software vendors or customized by employers must ensure these systems meet LHDN specifications and are certified by LHDN.

- e-Jadual PCB:

- Starting March 1, 2019, the PCB schedule provided by LHDN is in electronic form, known as e-Jadual PCB, accessible through the e-CP39 system.

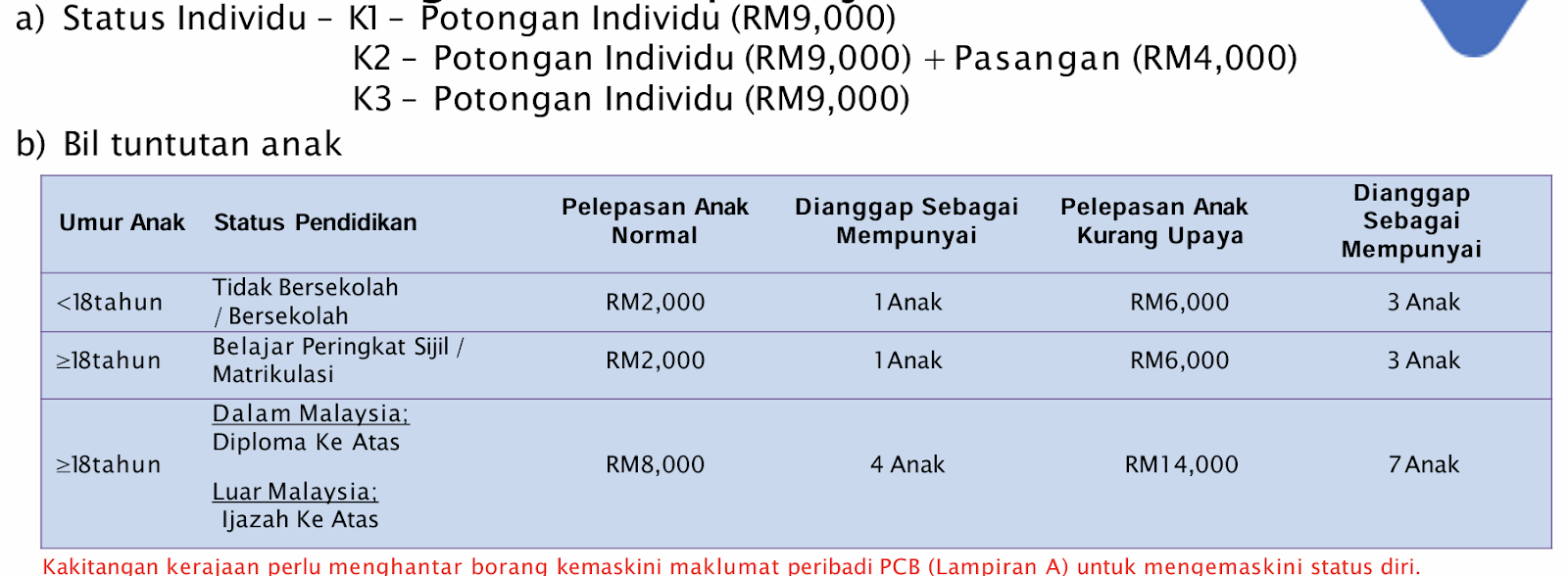

- Mandatory Deductions and Rebates:

- Mandatory Deductions:

- Individual Deduction (automatic)

- Spouse Deduction

- Child Deduction

- Contributions to the Employees Provident Fund (EPF) or other approved schemes

- Additional Deductions:

- Disabled individuals

- Disabled spouses

- Disabled children

- Mandatory Deductions:

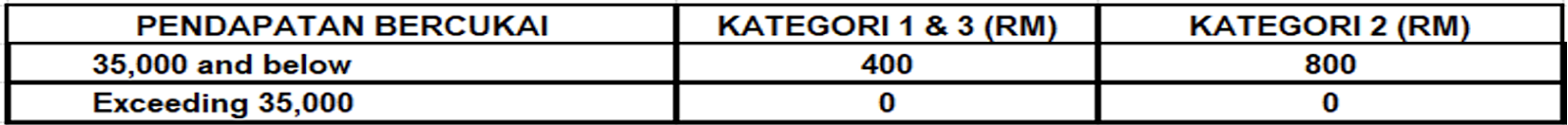

- Rebates:

- Zakat payments through salary deductions can be offset against the monthly PCB.

- Air travel levy rebates for Umrah or other religious pilgrimages are allowed twice in a lifetime.

- Employee Status and Categories:

- PCB calculations take into account the employee's marital status, number of children, and residency status.

- Different categories include:

- K1: Single

- K2: Married with non-working spouse

- K3: Married with a working spouse, or single parent with adopted children.

Why PCB Amounts Vary Each Year

The PCB (Potongan Cukai Bulanan) amounts can vary each year due to several factors, including:

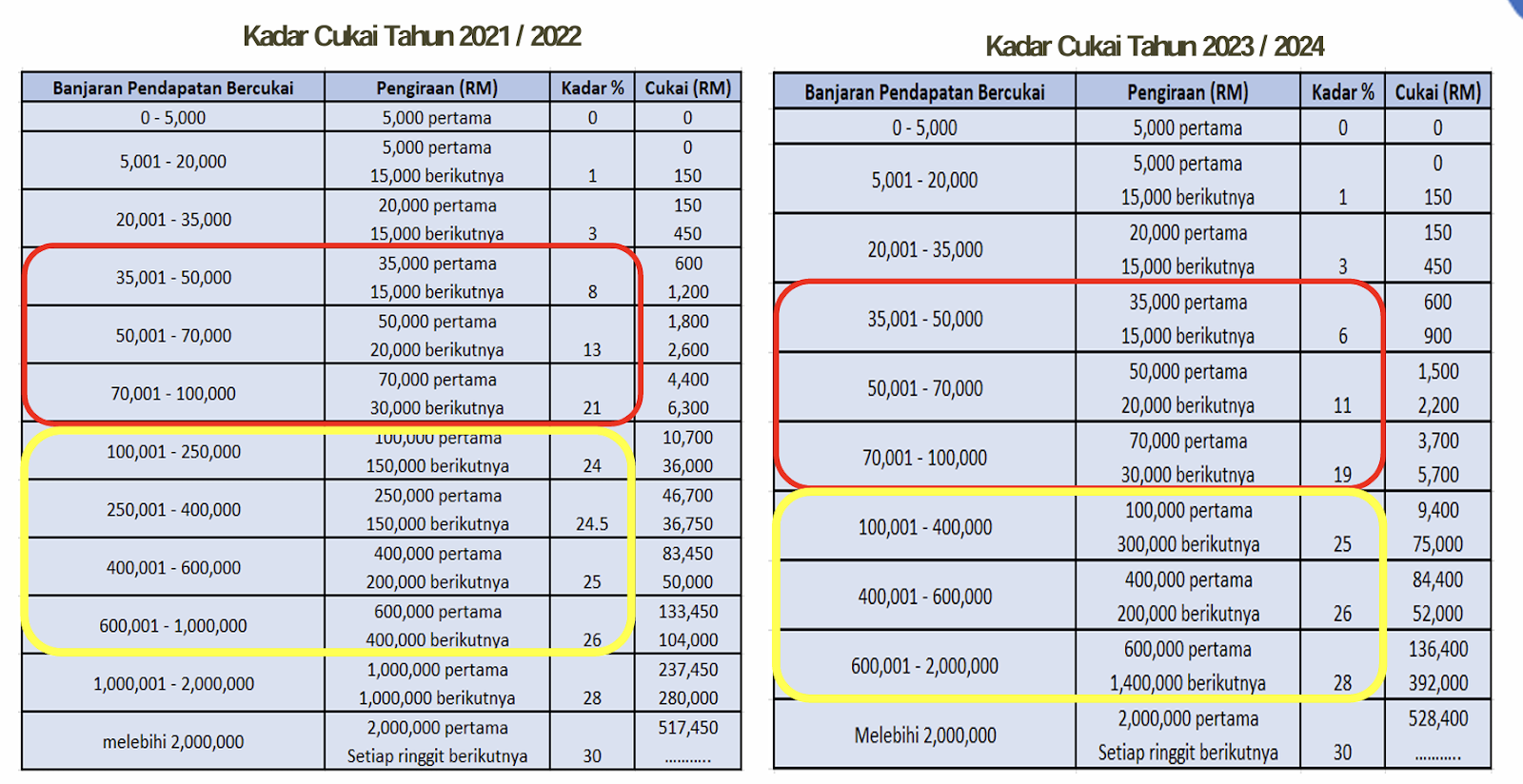

- Changes in Tax Rates:

Tax Rate Malaysia

- Tax rates are subject to revision in the annual budget. Changes in these rates will directly affect the PCB amounts for the year.

- Changes in Employee Status:

- An employee's personal circumstances, such as marital status or number of dependents, can change from year to year. These changes are taken into account when calculating PCB.

- Income Fluctuations:

Rebate Adjustment according to Income

- Variations in an employee's monthly or annual income, including bonuses, commissions, and other additional earnings, can result in different PCB amounts .

By understanding these factors, employers can better manage their payroll processes and ensure accurate tax deductions for their employees.

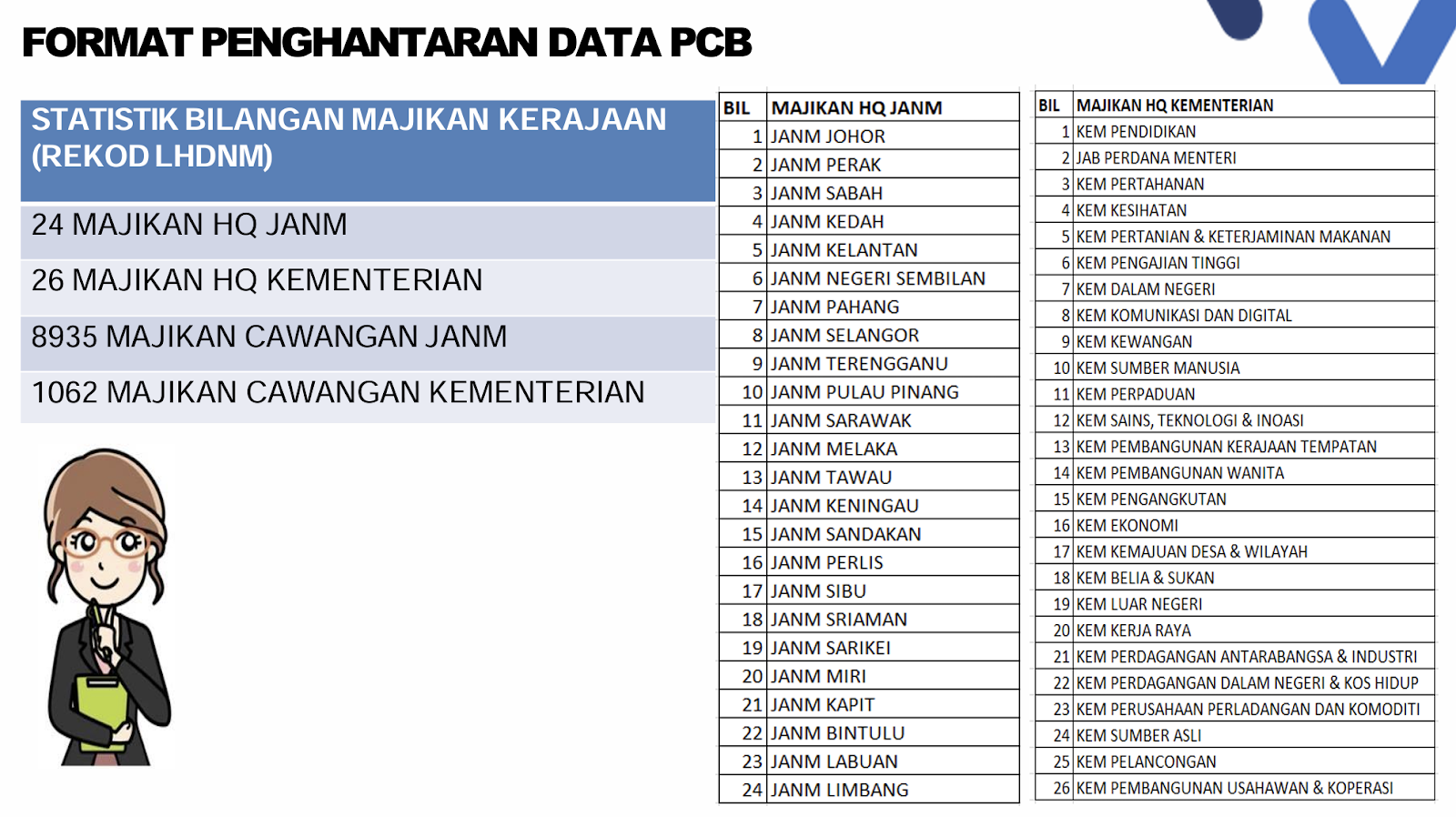

Methods and Format for PCB Payment and Data Submission

Employers must follow specific methods and formats when submitting PCB payments and data to LHDN:

- Payment Methods:

- Payments can be made through various instruments such as cheques, money orders, postal orders, and bank drafts. However, as of August 2023, LHDN has discontinued manual payment instruments at certain centers and banks. Employers are encouraged to use online payment methods through authorized banks and the LHDN portal.

- Data Submission Formats:

PCB Submission Format

- Employers must ensure that all data submissions for PCB are accurate and complete. The required information includes:

- Name of the employee

- Identification number (NRIC/Passport for foreign employees)

- Tax Identification Number (TIN)

- Amount of PCB/CP38 deducted

- Employers must use the prescribed file formats when submitting data electronically. Incomplete or inaccurate data submissions may result in the rejection of PCB payments.

- e-Data PCB and e-CP39:

- e-Data PCB: For employers with computerized payroll systems, this service allows for the upload and submission of PCB payment data online.

- e-CP39: For employers without computerized payroll systems, this service facilitates the calculation and online submission of PCB payment data using e-Jadual PCB and Kalkulator PCB .

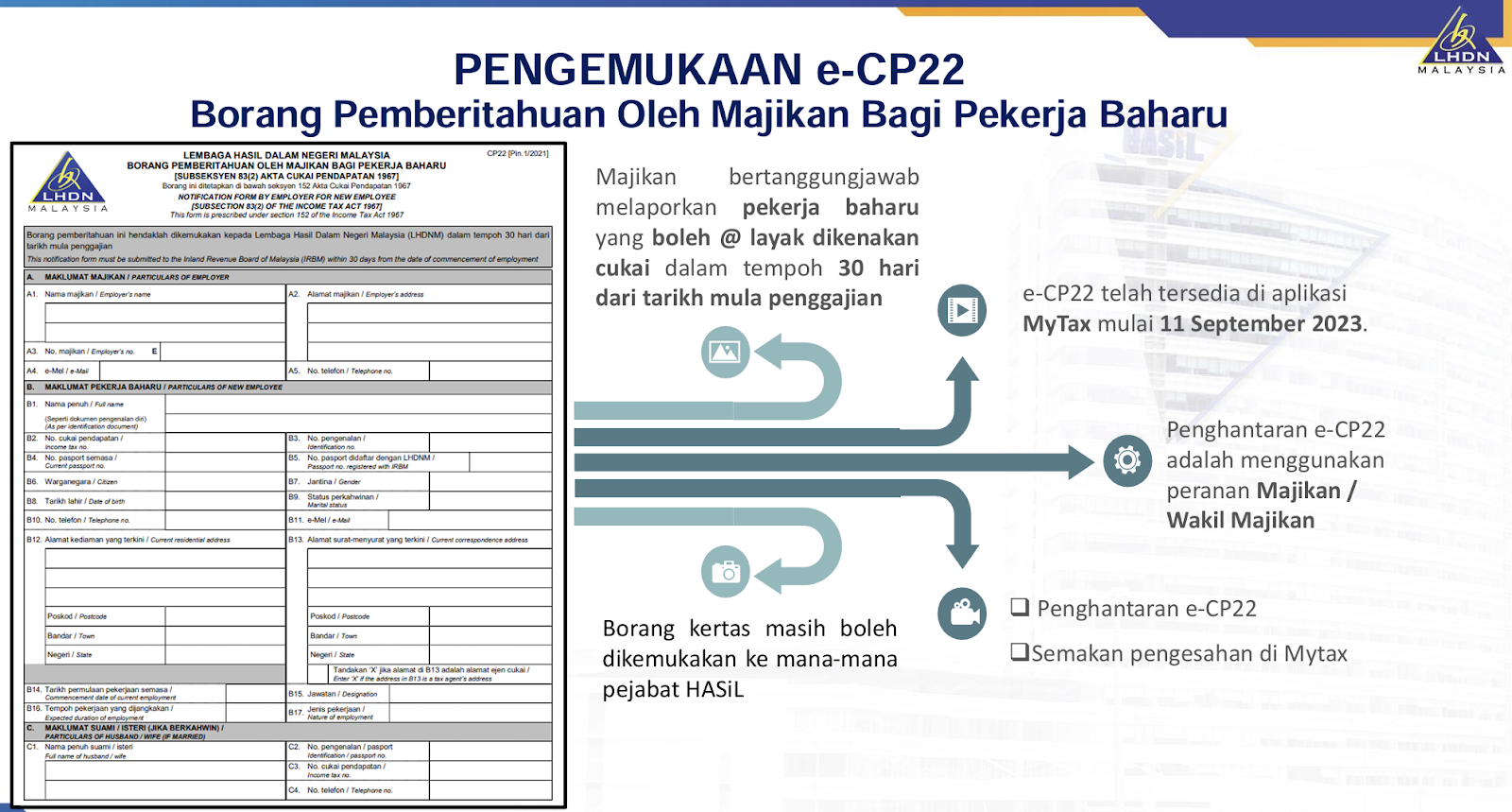

e-CP22: Notification of New Employees

LHDN e-CP22

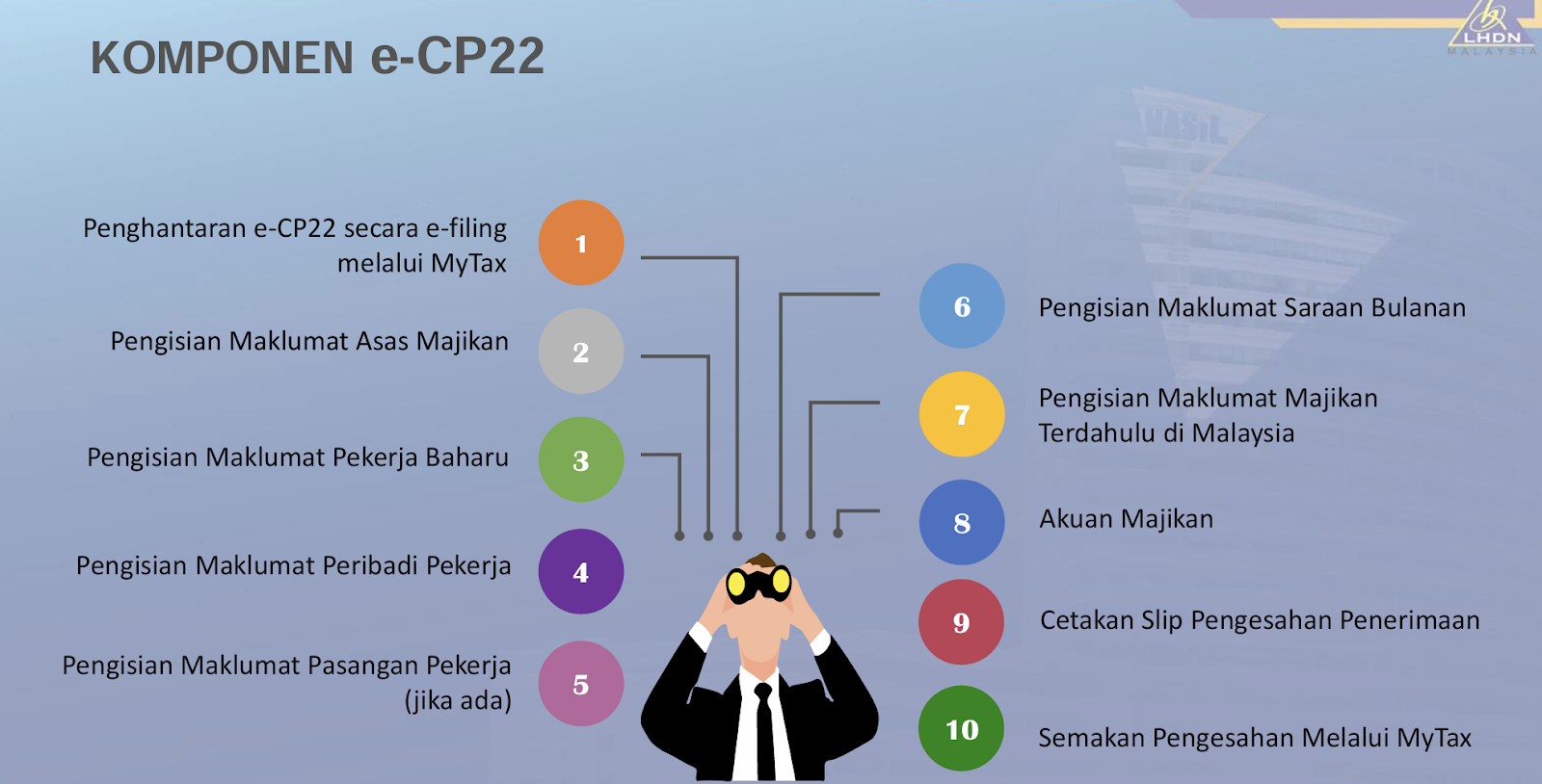

Starting July 1, 2024, employers are required to submit CP22 notifications for new employees electronically via the MyTax portal. The e-CP22 submission involves the following steps:

- Accessing MyTax:

- Visit the MyTax website and log in using the employer's identification number and password.

- Select the role of Employer/Employer Representative.

- Filling Out Basic Employer Information:

- The system will pre-fill basic employer information, which can be edited if necessary.

- Entering Employee Information:

- Employers can input data for new employees individually or in bulk using a .txt file. Bulk submission is currently in the testing phase.

- Completing the Submission:

Elements Needed in e-CP22

- Review and confirm the information before submitting. A confirmation slip can be printed for records.

Borang EA/EC: Annual Statement of Remuneration

Employers must prepare and deliver Borang EA/EC statements to their employees by the end of February each year. These statements summarize the employees' earnings and tax deductions for the previous year. Key points include:

- Content of Borang EA/EC:

- Gross income, including salary, allowances, bonuses, and other earnings.

- Details of tax deductions and contributions to EPF or other approved schemes.

- Distribution to Employees:

- The statements must be provided to employees on or before the last day of February each year【14†source】 .

e-SPC: Tax Clearance for Employees Leaving Malaysia

The e-SPC system is used for processing tax clearance applications for employees who are leaving Malaysia for more than three months, retiring, or passing away. Employers must:

- Submit Notifications (CP21, CP22A, CP22B):

- CP21 for employees leaving Malaysia.

- CP22A for employees retiring or passing away (private sector).

- CP22B for employees retiring or passing away (government sector).

- Hold Payments:

- Employers must withhold any payments to the employee until tax clearance is obtained from LHDN.

- Electronic Submission:

- Submissions are made through the MyTax portal. Supporting documents must be uploaded as required.

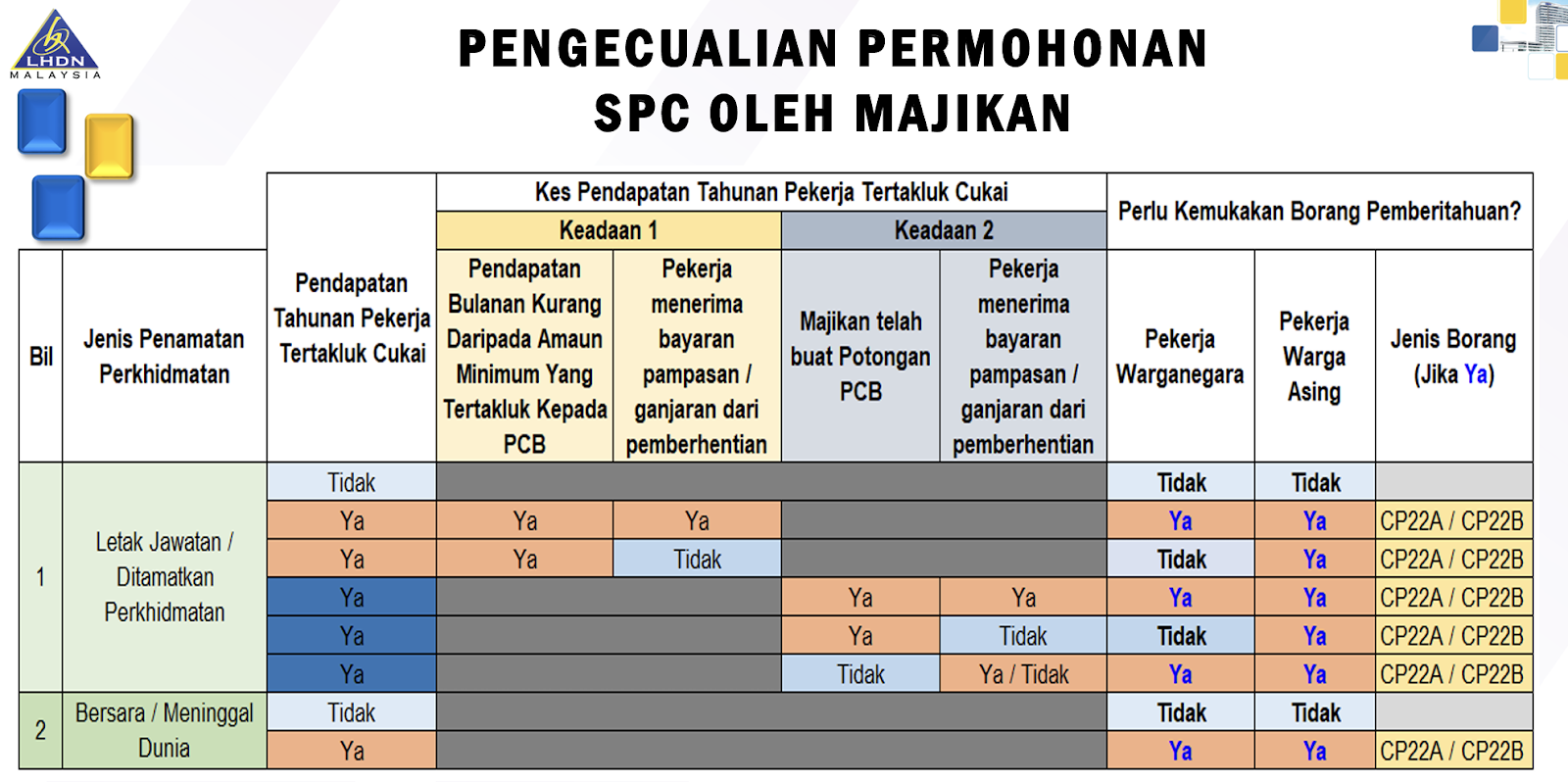

Exemption from e-SPC Application

Exemption from e-SPC Application

Certain employees are exempt from submitting the Sijil Pelepasan Cukai (e-SPC) application under specific conditions. These exemptions are designed to streamline the process for employees whose circumstances meet particular criteria, ensuring that the tax clearance procedure is efficient and straightforward.

Criteria for Exemption

Employees are exempt from the e-SPC application if they meet any of the following conditions:

- Employees Who Cease Employment Without Taxable Income:

- Employees who are stopping work or retiring and have no taxable income.

- Malaysian Citizens in the Public Sector:

- Employees who are Malaysian citizens and work in the public sector or statutory bodies.

- These employees must be leaving or intending to leave Malaysia to:

- Work and carry out their duties outside Malaysia.

- Pursue any course of study at an institution or professional body outside Malaysia, fully sponsored by their employer.

- Employees Subject to Monthly Tax Deductions (PCB):

- Malaysian citizen employees who are stopping work from any employment where their monthly income is subject to PCB and do not receive any compensation or gratuity from the termination.

This exemption helps to simplify the process for specific groups of employees, reducing the administrative burden on both the employees and employers.

How Kakitangan.com Can Help in Employer Responsibilities

Kakitangan.com offers a comprehensive suite of HR solutions designed to simplify employer responsibilities, ensuring compliance with Malaysian regulations and enhancing operational efficiency. Here’s how Kakitangan.com can assist:

Payroll Management

Kakitangan.com provides a robust online payroll system that automates the payroll process, reducing errors and ensuring timely salary payments. The platform integrates with various bank systems and accounting software, facilitating smooth financial operations. It handles statutory deductions such as EPF, SOCSO, and tax calculations, keeping you compliant with the latest regulatory updates.

Leave and Attendance Management

Kakitangan.com’s E Leave and E Attendance modules streamline the management of employee leave and attendance. These features help track leave balances, approve requests, and maintain accurate attendance records, ensuring adherence to employment laws.

Employee Documentation

The platform simplifies the generation of essential documents such as payslips and EA forms. Kakitangan.com’s automated system ensures that all necessary details are included, making the documentation process efficient and compliant with statutory requirements.

Expense and Claims Management

The E Claim module allows employees to submit expense claims digitally, reducing paperwork and ensuring quick approvals and reimbursements. This feature helps maintain accurate financial records and simplifies the expense management process..

Training and Support

Kakitangan.com provides ongoing support and training for its users. Through community series events and onboarding sessions, employers and HR personnel can stay updated on best practices and new features, ensuring they make the most of the platform’s capabilities.

Why Use Kakitangan.com

By utilizing Kakitangan.com’s comprehensive HR solutions, employers can ensure compliance with Malaysian regulations, improve operational efficiency, and focus more on their core business activities. For more information, visit Kakitangan.com.

Get Going Right Now!

Join our Community Series: Mastering Statutory Contributions and Employee Benefits 21 August 2024 with LHDN Officer (Physical Event). Sign up for the training here: https://www.kakitangan.com/company/events/community-series/2024/august