Common data issues when you fill up the data for the first Payroll

Normally, the first month is the hardest – you’re changing the practice from existing to a new system/process. And we are human – things happen that we overlook certain things when we set it up.

Company

-

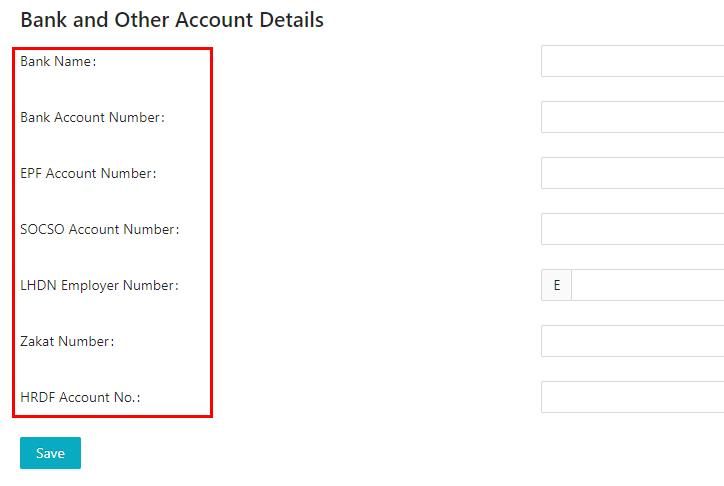

Common missing items: Company Registration Number, Bank Account Number, Company EPF/SOCSO/LHDN Numbers, authorized person, pro-rata setting.

-

Before you get these data completed, the file generation for online payment is not shown in the Payroll Summary report.

-

Setup the system data in both

- Dashboard->Company Settings; and

- Bank and Other Account Details

Employee

-

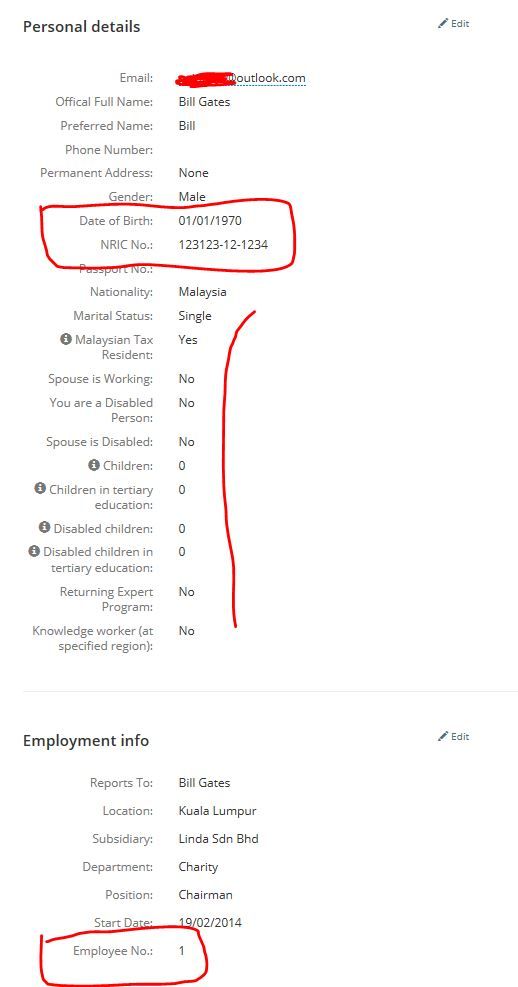

Common overlooked one: Employee number (not employee EPF number). EPF somehow requires your employee number in their text file to submit to EPF website

-

Date of birth is the common one that EIS/EPF/SOCSO calculation goes wrong

-

NRIC is must in most of the text file output

-

Be really careful on the “Malaysian Tax Resident”, if you uncheck it, it means this person is not Malaysian Tax Resident and get charged with the maximum rate in PCB.

Payroll

-

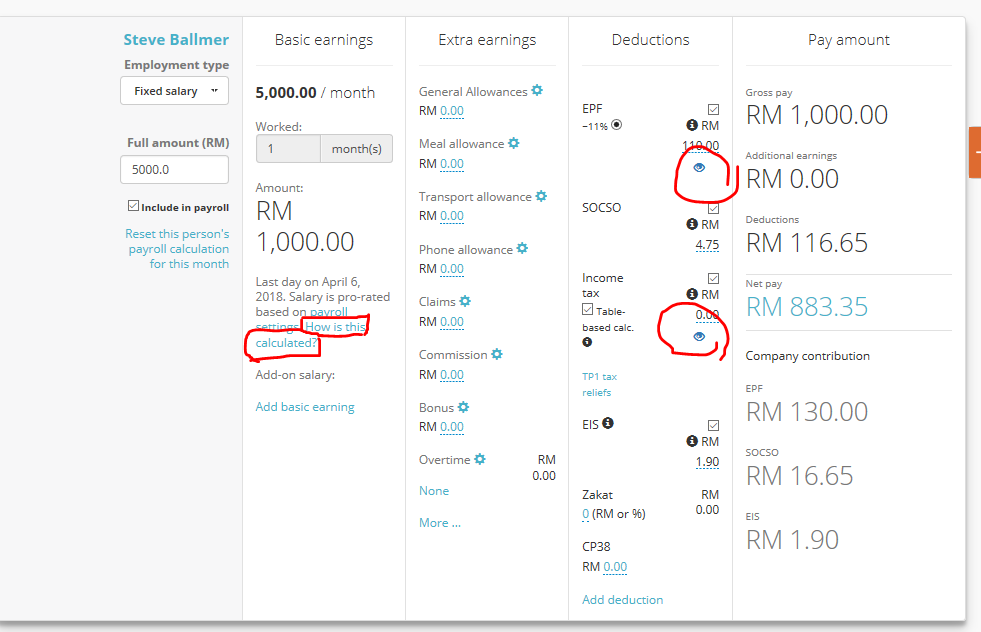

Many people edited the amount in EPF/SOCSO/LHDN – and forgot about it. The system assumes you want such number, and will carry forward the number to the following months. Make sure you remember to key in “-1” there to refresh it to the formula calculation.

-

How do you know whether it’s a pre-set number, or how do you know how the calculation is derived at? Click the little eye button in the payroll calculator.

-

Be careful if you create extra allowance or deduction items – are they applicable to EPF/SOCSO/LHDN?

-

Bonus has a very different PCB calculation mechanism – it gets divided into 12 in the PCB formula.

-

Transport Allowance is up to RM6000 a year.

-

Remember to input the aggregated numbers this year, before using Kakitangan.com – the system will add them into the EA/E forms. /how-to-get-ea-e-form-done/

Hope it helps!

how to setup Kakitangan.com so you can automate the max for your payroll and people operation /onboarding-your-company-to-kakitangan-com-for-the-first-time/