E-Data PCB: Generating and Submitting the PCB Text File

Malaysian workers are subject to various deductions on their income, from notable sources like EPF. Aside from compulsory financing schemes, taxpayers also contribute to PCB, a monthly tax that can be paid via the e-Data PCB portal.

It is important for members of the workforce to be aware of mandated funds and taxes impacting finances. These details can affect the way we view our daily expenditure and impact our finances at large.

For employers, understanding PCB is a responsibility that should be upheld. Read the article to learn how to use LHDN’s e-Data PCB tool for an automated PCB management and payment process.

A Brief Description of PCB

Contributing towards the payment of employee income taxes at the end of the financial year, PCB stands for Potongan Cukai Bulanan. Payment towards the scheme is scheduled monthly and is handled by employers.

Various remunerations are subjected to PCB aside from an employee’s monthly salary. The more commonly known include overtime payments, commission, tips, bonuses and allowances.

Director’s fees, perquisite, employee’s share option scheme (ESOS), tax borne by the employer, compensation for loss of employment, and gratuity are also subject to PCB.

Read More: What Is PCB: The Ultimate Guide

Export e-Data PCB file from Kakitangan.com payroll

Upon the payroll is confirmed, you may process pcb payment next by following below steps,

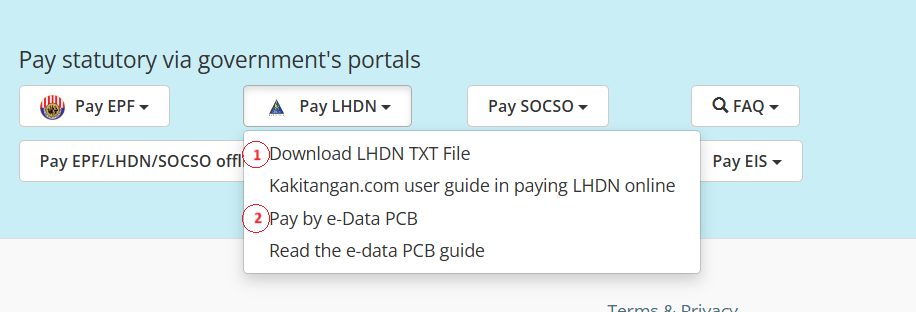

Go to payroll summary page -> scroll down to Pay LHDN entry point -> Click on Download LHDN txt file -> Click on Pay by e-Data PCB, you will be redirected to e-Data PCB system to login.

Step-by-Step Guide to e-Data PCB

(Updated as of 27th Jan 2025)

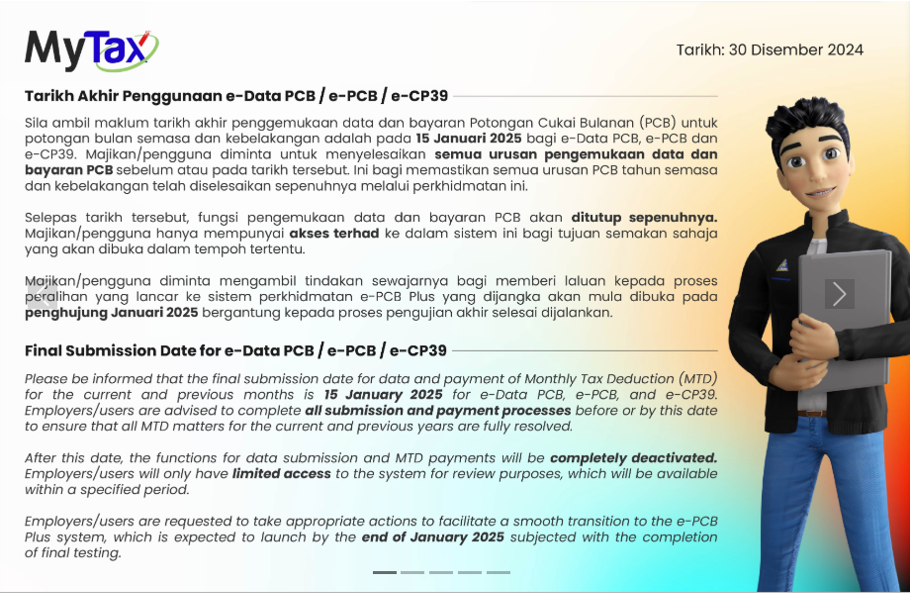

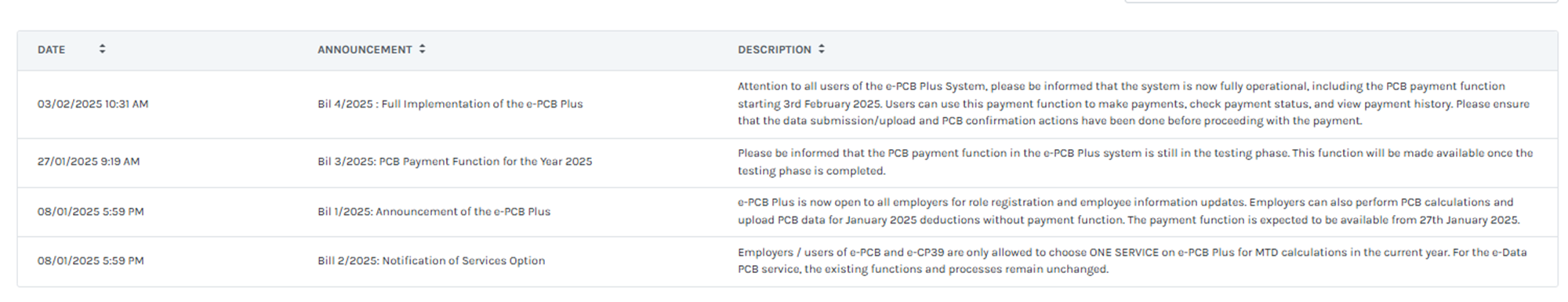

Do take note that all future payments will be moved from e-Data PCB to e-PCB Plus system, and this is the message from https://mytax.hasil.gov.my/:

You may still review and print past PCB information/records via e-Data PCB system. All users will be notified in advance before the official launch of the e-PCB Plus system.

Below guides are for Employer,

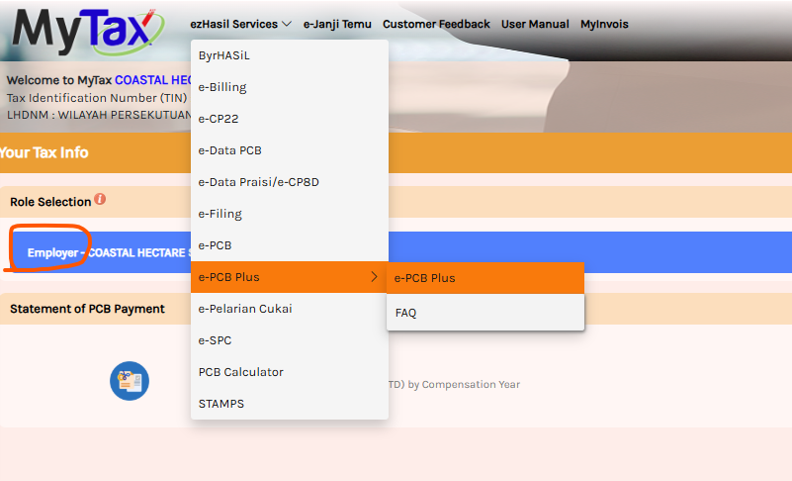

To make the payment, login to https://mytax.hasil.gov.my/, and change your role to Employer (need to apply necessary permission if you don't have). After that, select e-PCB Plus from the drop-down menu:

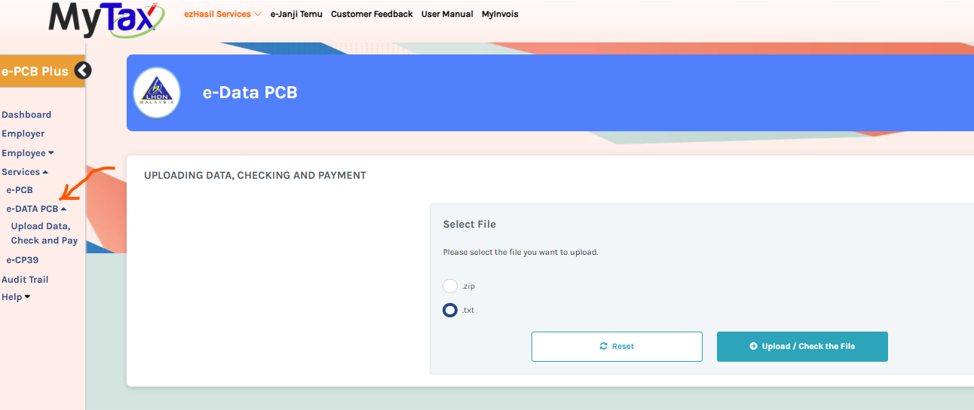

On your left, choose Services and then e-DATA PCB, and you will be presented with an option to upload the text file generated in Kakitangan.com (as previously used in e-Data PCB). Click "Upload/Check the File" button:

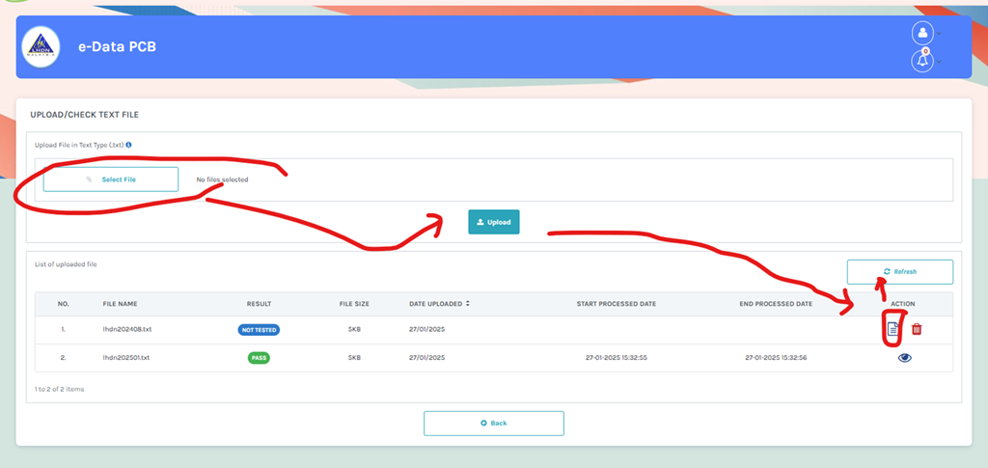

Select the text file generated in Kakitangan.com, then click upload and click on the button “Check Data”. Then refresh.

(Note: when we try ourselves on 3 Feb 2025, the refresh button immediate change the processed file to fail or pass. But we heard cases that the LHDN system is overloaded later, that the refresh is still showing "being processed". In that case, what we heard is come back again the second day and refresh it. - So, don't pay PCB last minute at 14-15 Feb range yaaaa!!!)

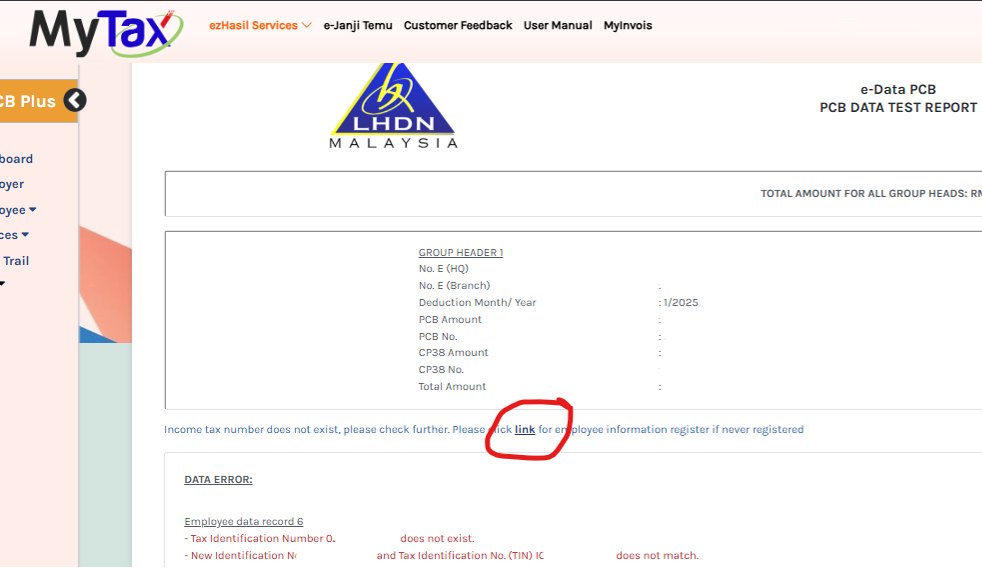

If it’s failed, you may need to update the TIN number on the employee profile’s compensation tab in Kakitangan.com. Previously, the old e-data PCB doesn’t do a tight check on TIN number. They do now. Don’t worry, next slide tell you how to get latest TIN number of staff.

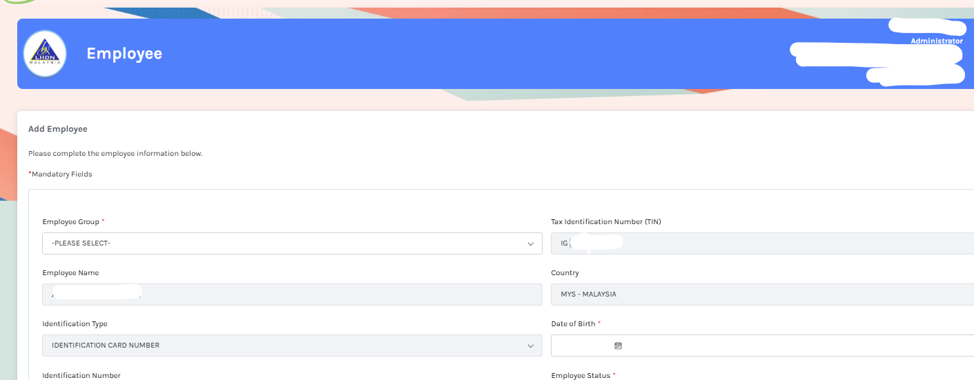

When you add the staff IC in the e-PCB Plus, you are able to see the TIN number of the person.

Special note: if it’s 10 digits, please add a ‘0’ at the front of the number with you add this into Kakitangan.com system user profile. If it's tallied with the NRIC record in LHDN you should be fine. We were thinking to auto add 0 for you, but it will break some bank’s LHDN payment file. So, for e-data PCB users, let’s add the 0 at front first.

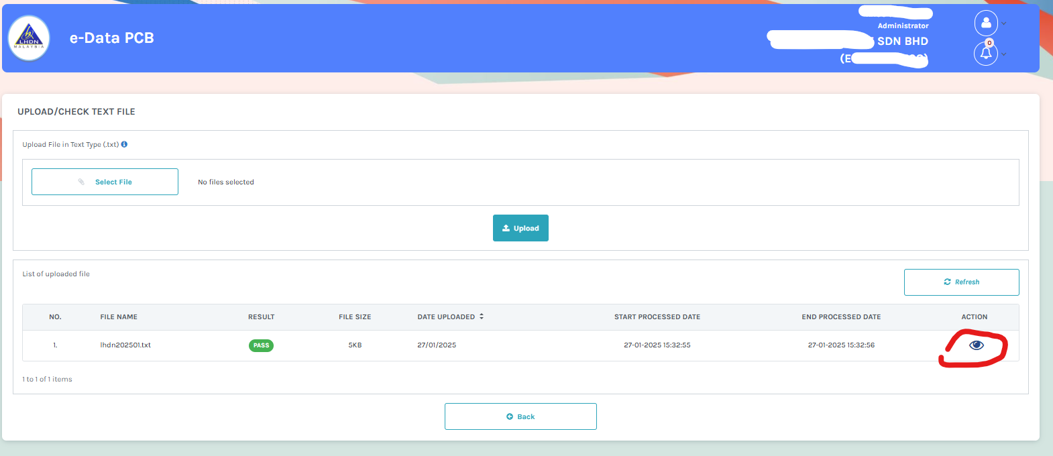

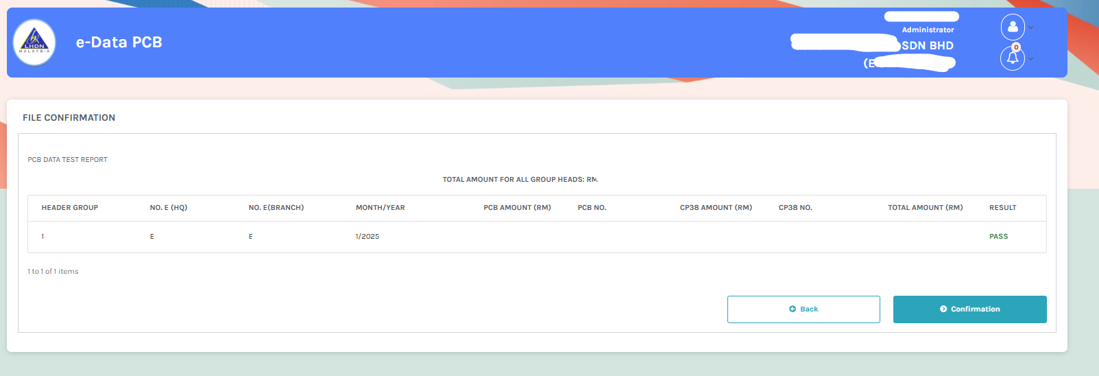

If everything is fine, then it will give you a pass as result then click on EYE button as to view the data.

You can then confirm the submission,

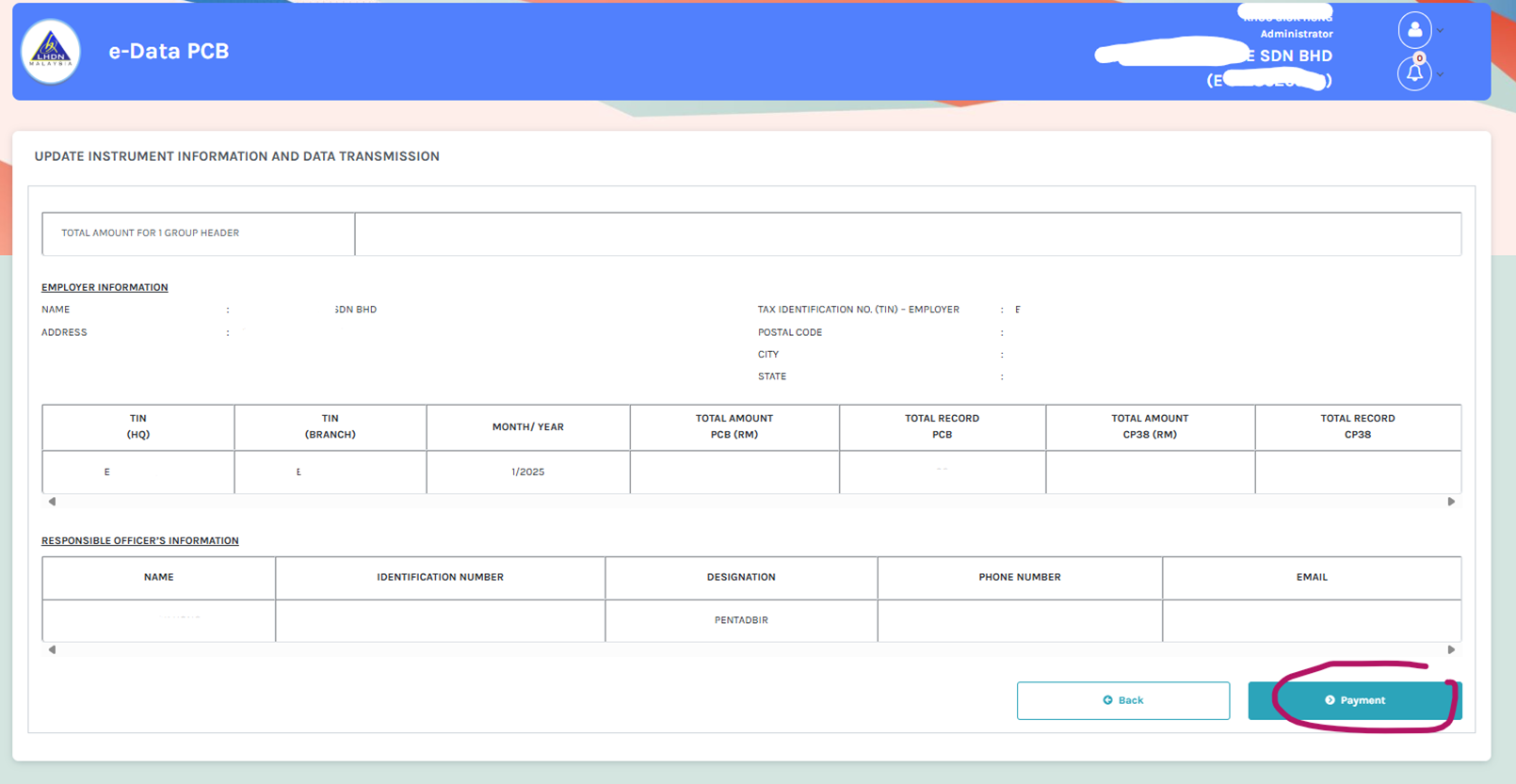

Double check all the data, then click on Payment.

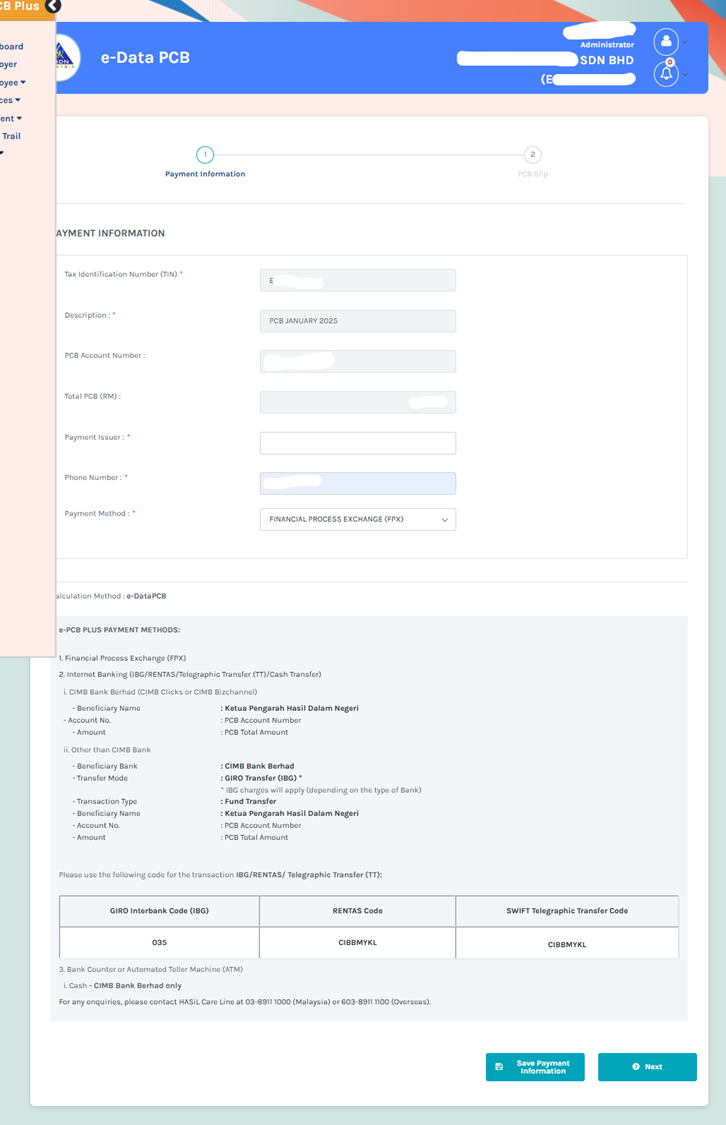

Double check the data and click on Next.

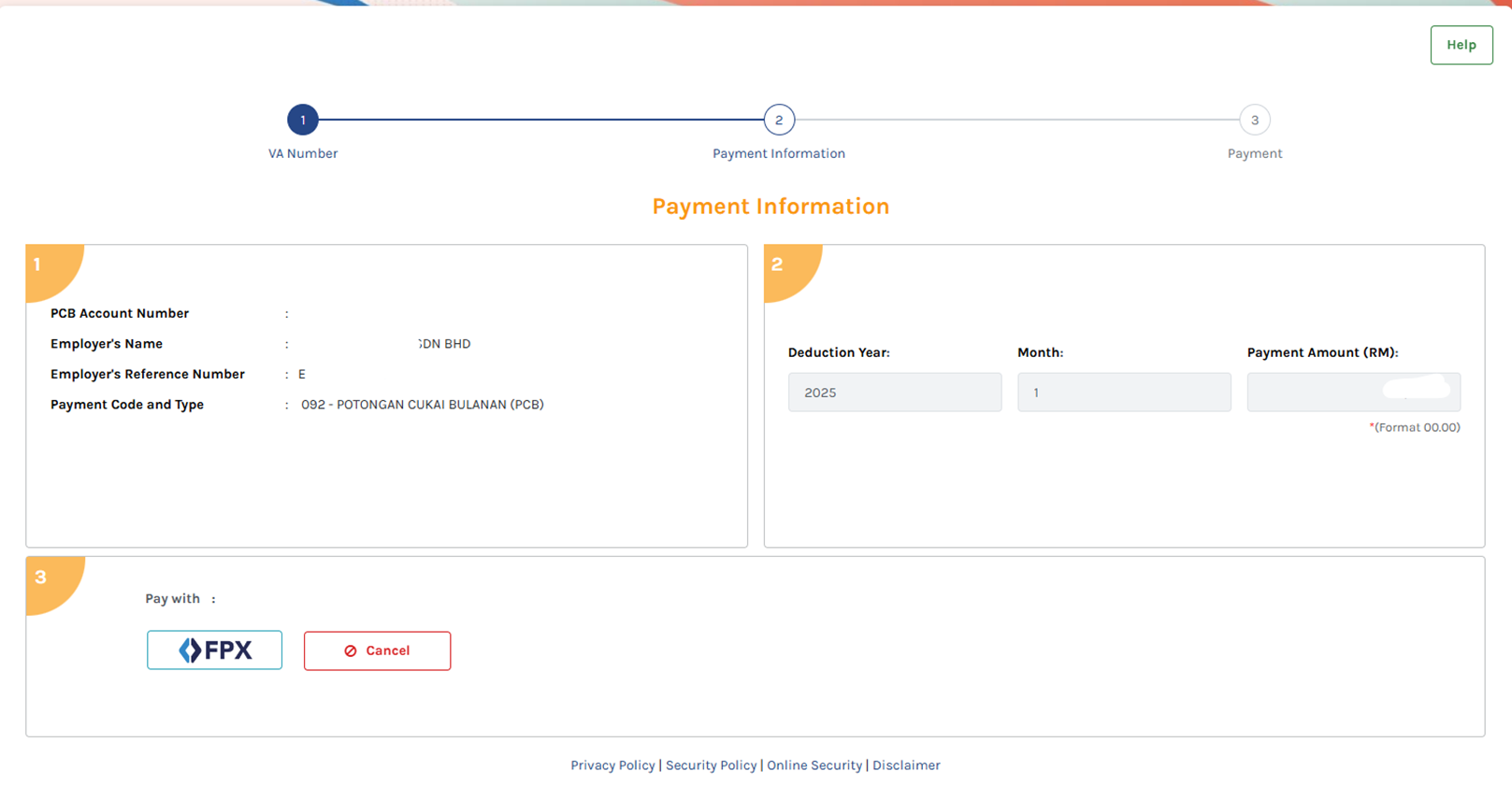

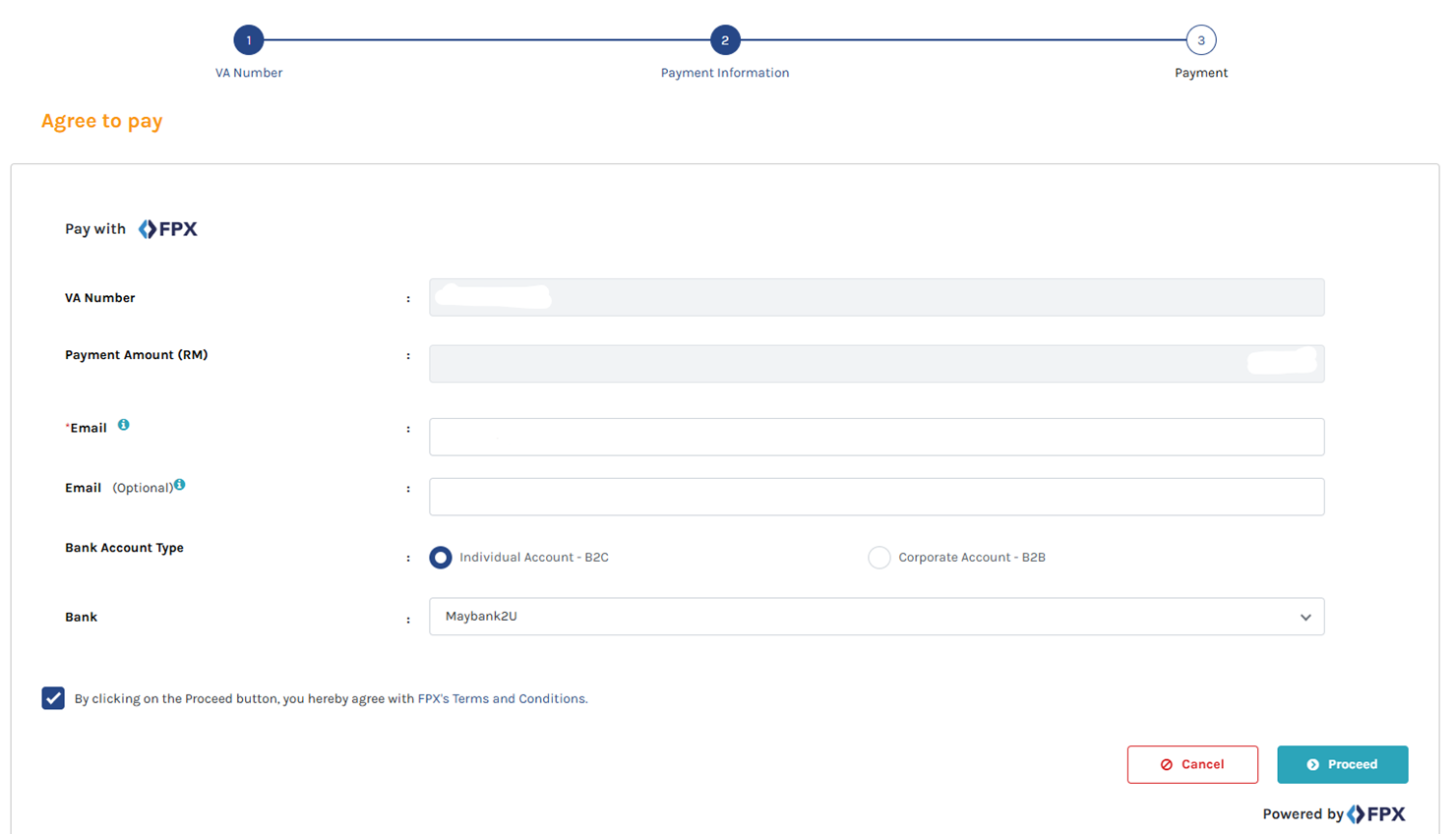

Double check the data and click on FPX.

Double check the data and click on Proceed.

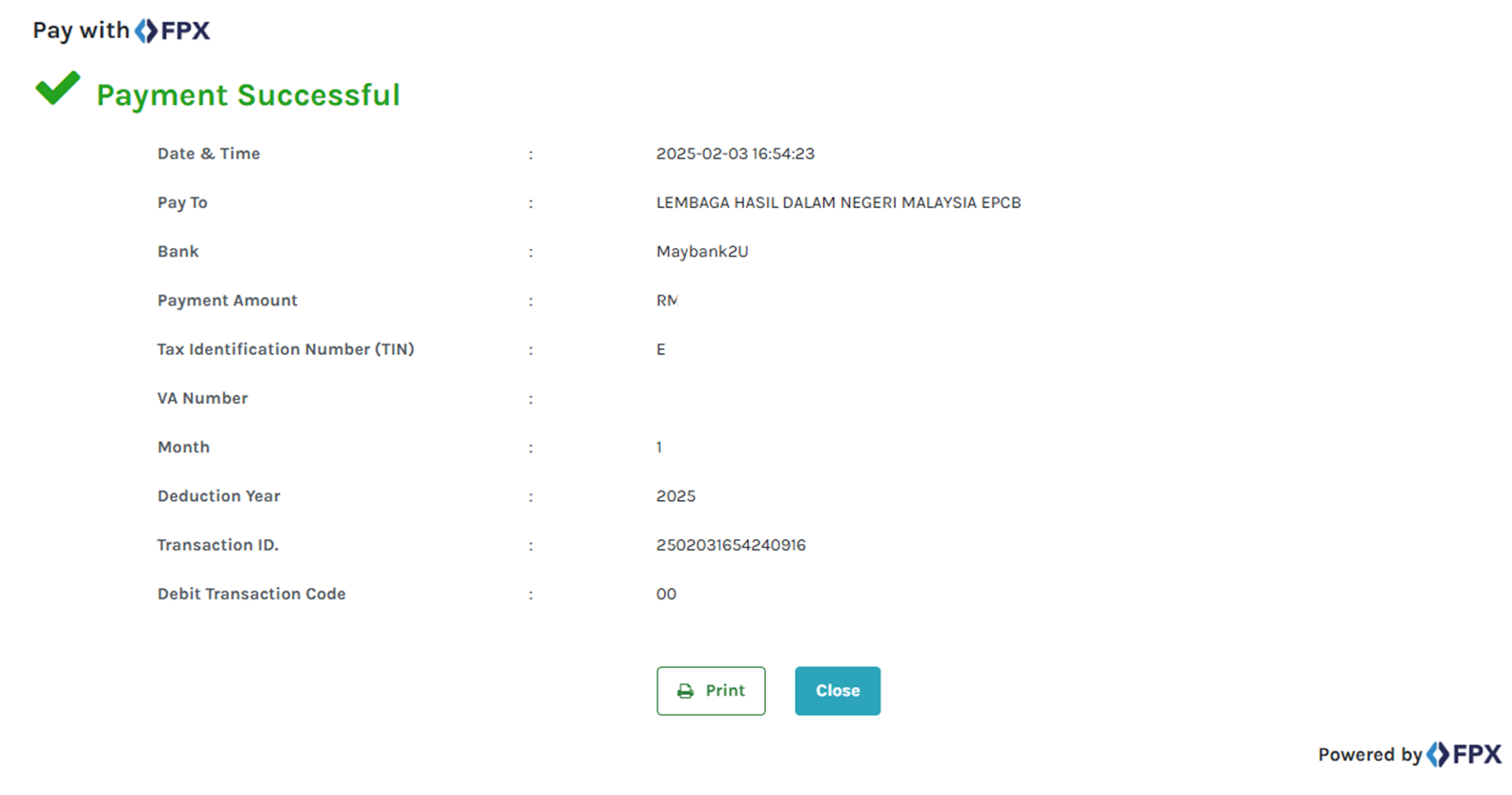

After the bank login screens and authorization. Congratulation, you've completed the steps! Now click Print to download the receipt.

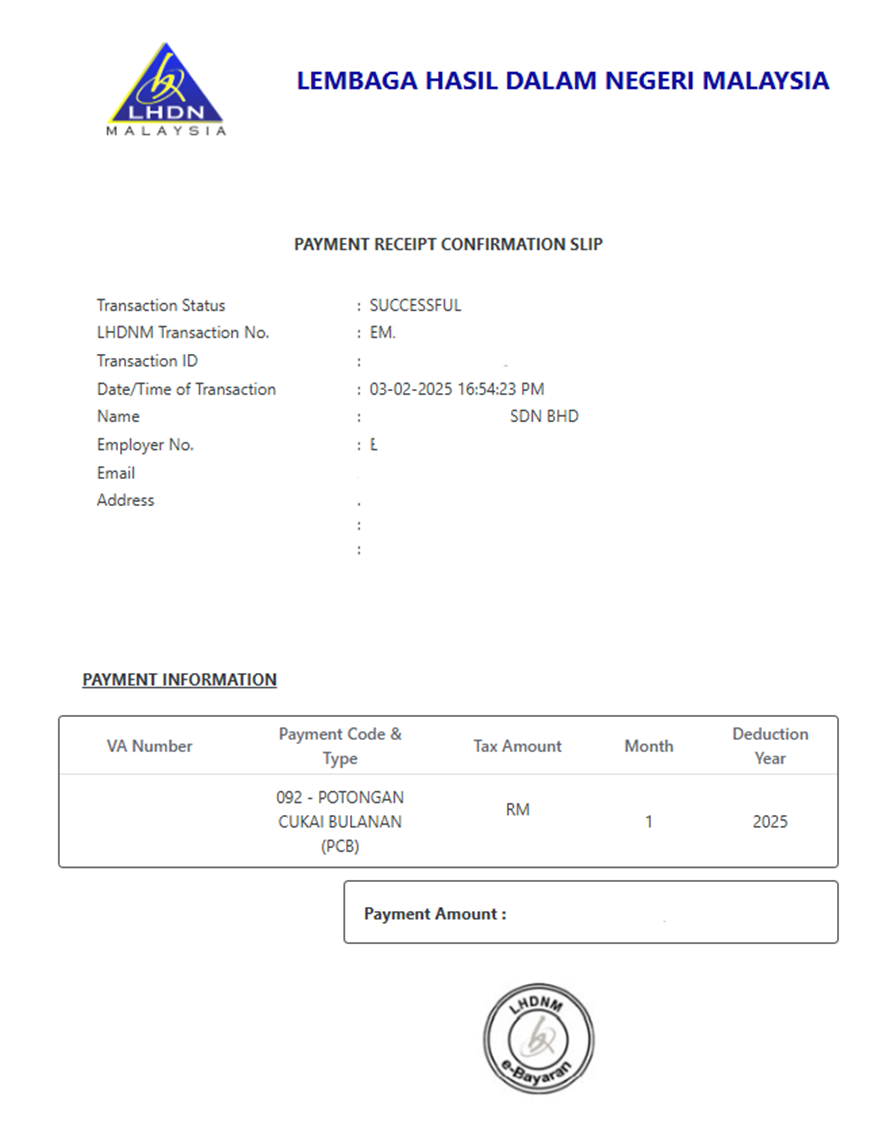

This is how the receipt looks like in PDF available to download.

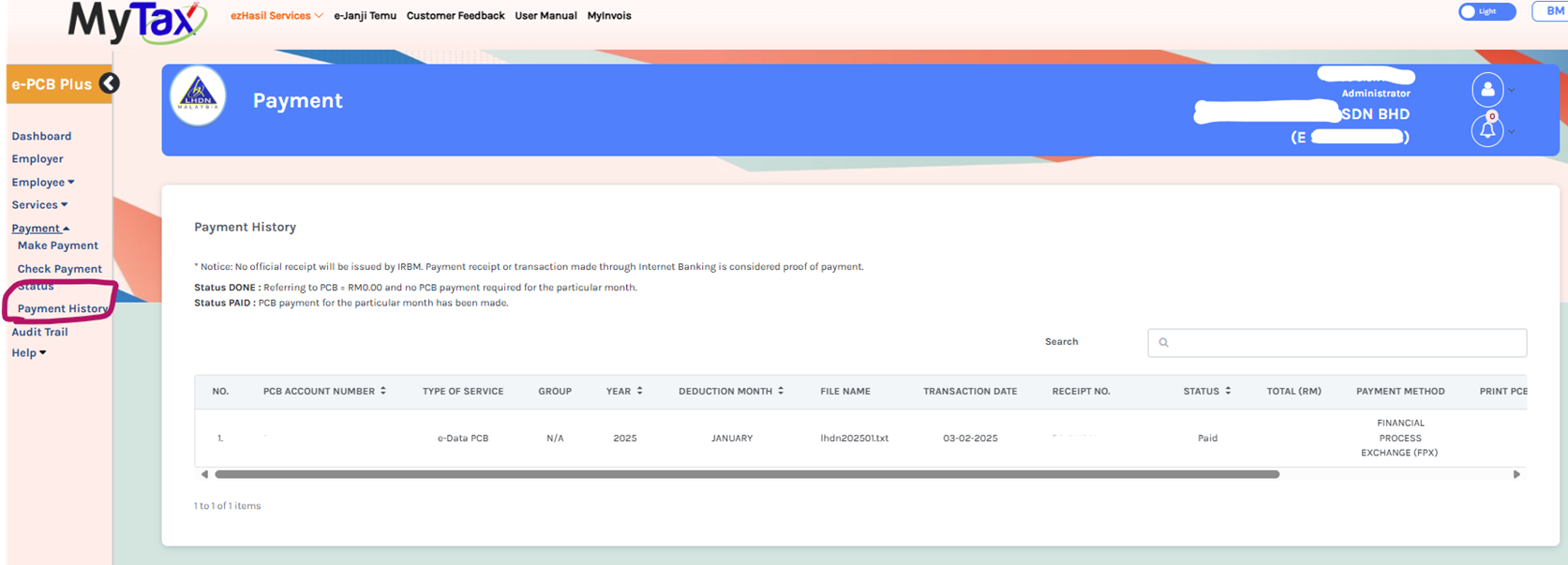

It also reflects in Payment History in the e-PCB Plus system.

Current Status: 3rd Feb 2025 payment function is ready.

Learn more about important taxes like the PCB and other topics surrounding business and finance in Malaysia by visiting Kakitangan.com’s main blog or reaching out to our HR team at sales@kakitangan.com.