Who should register as income taxpayer?

Any working Malaysian citizen are required to file taxes if you make more than RM37,333 annually after the Employees Provident Fund (EPF) deduction. You may refer to tax exemption HERE.

First time to register as taxpayer? Here’s a guide for you.

Online Registration

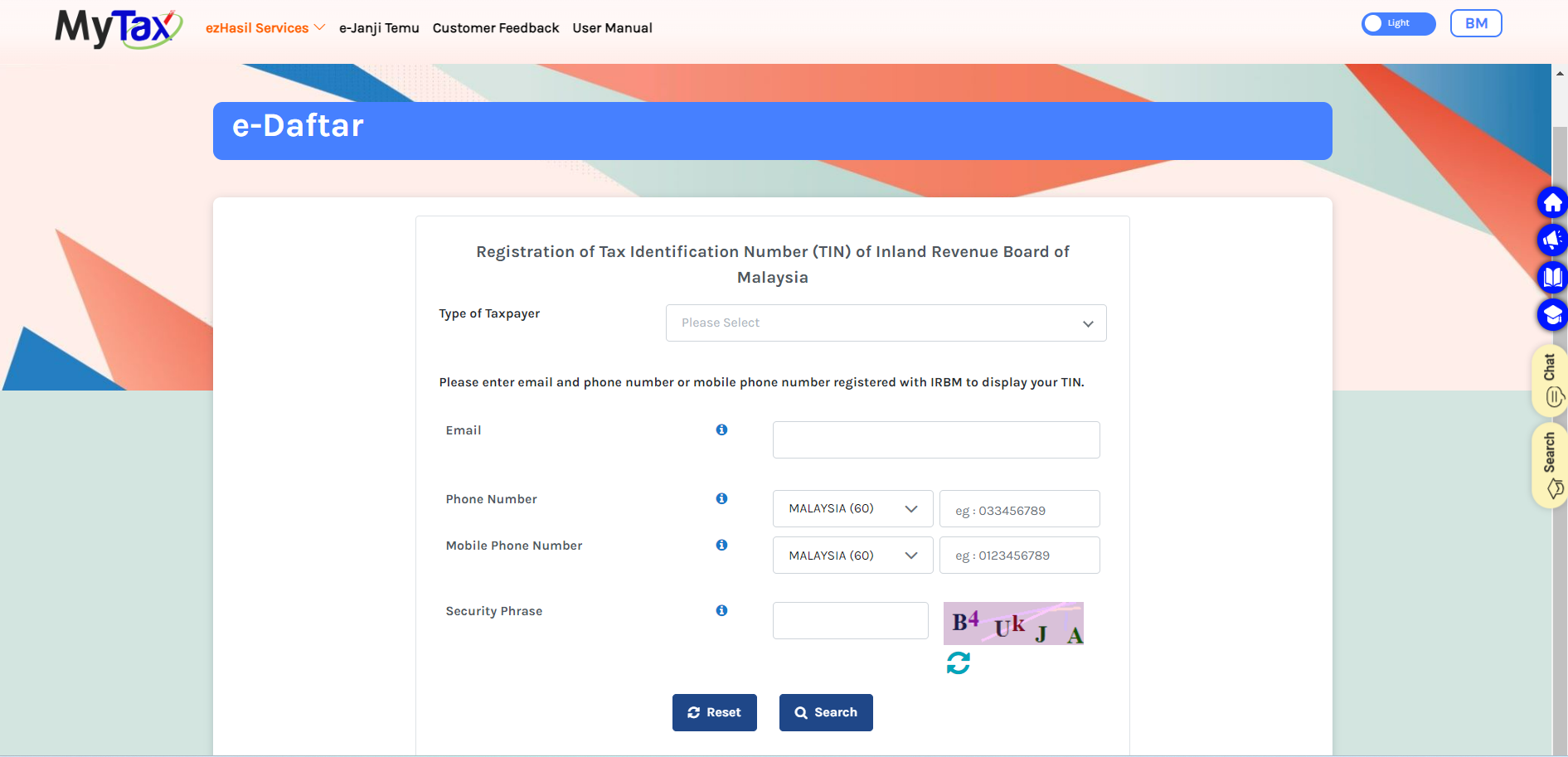

1. Go to https://mytax.hasil.gov.my/

2. Click “e-Daftar”.

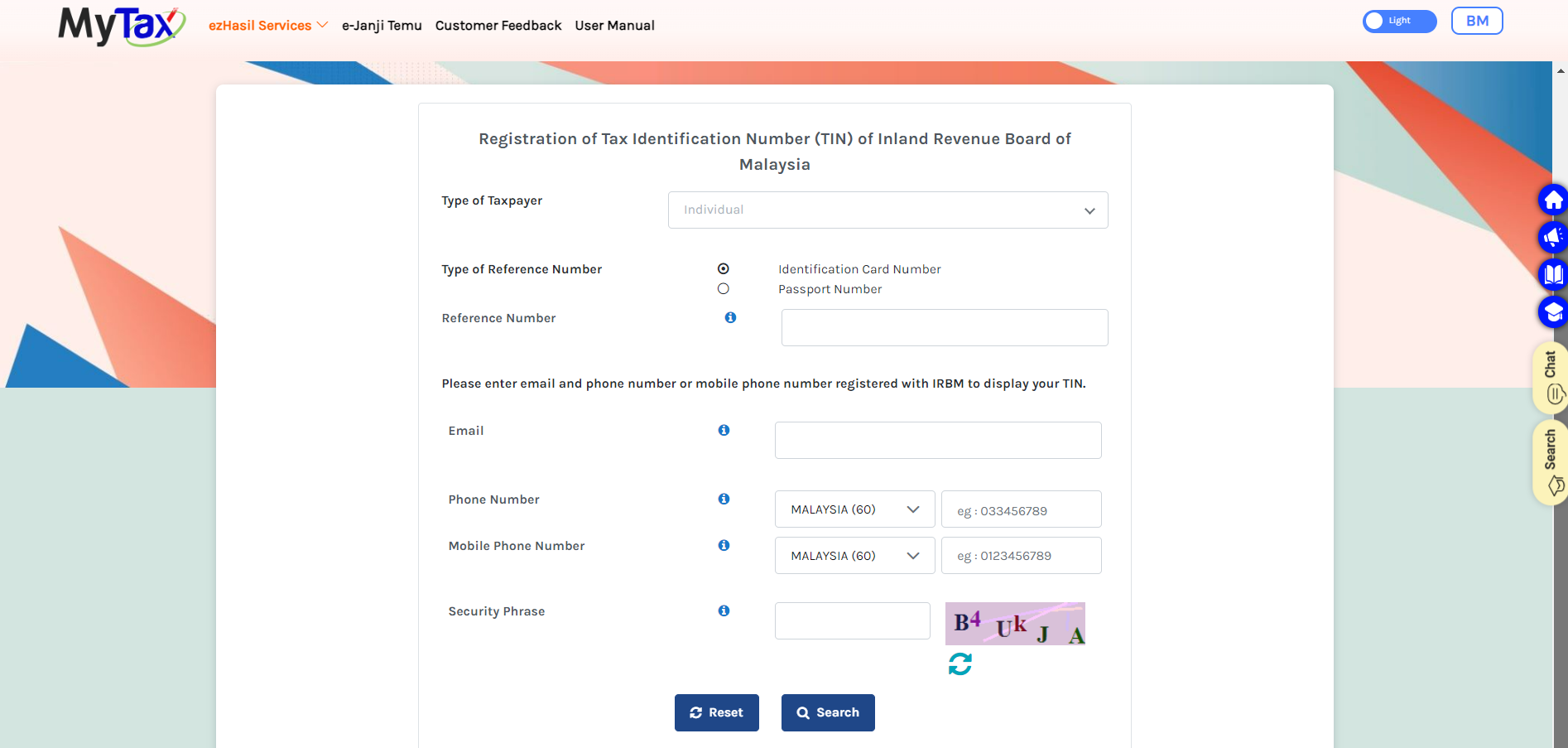

- Go to “Type of Taxpayer”, select “Individual” from the drop down.

- Type of reference number box will appear. Click on “Identification Card Number” and key in your identification number (IC number) in the box.

- Fill up the rest of the details accordingly: Email, Phone Number, Mobile Phone Number and Security Phrase.

- Then click “Search” button to check if your application is processed.

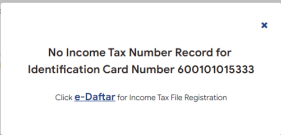

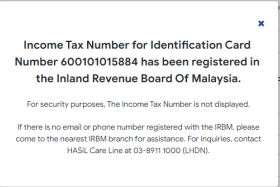

If you received this message:

Click e-Daftar and on the Update Details section, fill up all the required details.

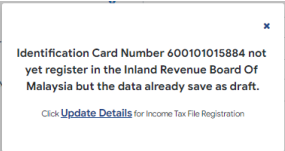

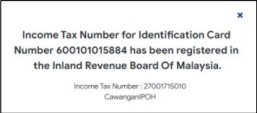

If you received this message:

Click on Update Details and fill up the required details.

If you received this message:

or this

Follow the instructions stated.

Once the registration is done, you need to go to the nearest LHDN branch to get your PIN number.

Documentations you need to bring:

a) A copy of your MyKad

b) A copy of your pay slip or EA Form

c) Bring you marriage certificate (If you are married)

Once registered, you will receive an email of your income tax number within 3 working days. Then you can share the income tax number to you employer. If there’s any issue during your registration, you may contact LHDN office.

Employees don’t have Income Tax Number when payroll date is near

Let’s say your payroll date is nearing and one of the employees do not have income tax number. What will happen? If your company is using e-Data PCB to handle the PCB payments for your employees, it is acceptable for the employees to temporarily not to have an income tax number. The LHDN office can track using the employee’s NRIC number in the meantime.

All is good now. You can use Kakitangan.com system without hassle. All will be automatically calculated for you.

Try out our system today! Click HERE.