An important adjustment meant to improve tax processing and compliance efficiency has been announced by Malaysia's Income Tax Department. The e-PCB Plus System will combine the three current systems—e-PCB, e-CP39, and e-Data PCB—into a single, all-inclusive platform. What employers and staff need to know about the changeover is covered in great length in this article.

What is the e-PCB Plus System?

Combining the features of e-PCB, e-CP39, and e-Data PCB into a single platform, the e-PCB Plus System is intended to simplify the administration of Potongan Cukai Bulanan (PCB), or Monthly Tax Deductions. Accessible via the MyTax Portal, the system will use a Tax Identification Number (TIN) associated with the user's MyTAX ID.

Benefits of the e-PCB Plus System

- Unified Platform: e-PCB Plus System simplifies complexity and enhances user experience by integrating several systems into one.

- Efficiency: Employers will save time by centralizing and automating PCB data administration.

- Accuracy: Increased data accuracy guarantees adherence to tax laws.

Key Dates and Registration Process

The Launch Date

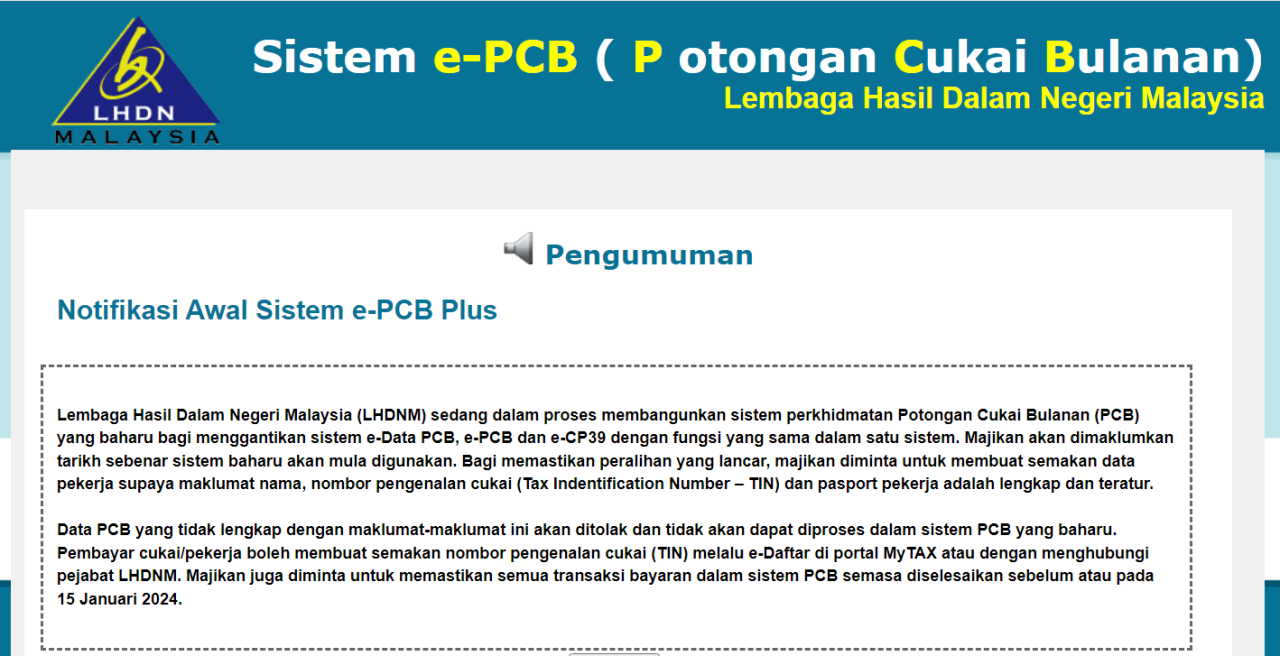

The Income Tax Department will make the precise e-PCB Plus System launch date known in due course. Employers who want to be prepared for the changeover should keep themselves informed.

TIN Registration

Applying online with the e-Register application on the MyTax Portal is required starting on January 1, 2024. TIN registration will be automatic for those eighteen years of age and older who are citizens of Malaysia and permanent residents.

Employer Responsibilities

A seamless transfer to the new system is mostly the responsibility of employers, who include:

- Registering Authorized Individuals: Make sure that every employee in charge of PCB computations and payments is registered and has a MyTAX ID.

- Accurate Employee Data: Check that names, TINs, and identity numbers (IC or passport) of employees are accurate and current. Processing of PCB can be hampered by errors.

- Transition Planning: Get to know the new system and its features.

Checking Your TIN

Employees and employers may confirm their TIN by

- going to the MyTax Portal Malaysia.

- Contact Centre: If calling from abroad, dial 603-89111100 or 03-89111000.

- HASiL Office: For help, stop by any local HASiL office.

Understanding e-PCB, e-CP39, and e-Data PCB

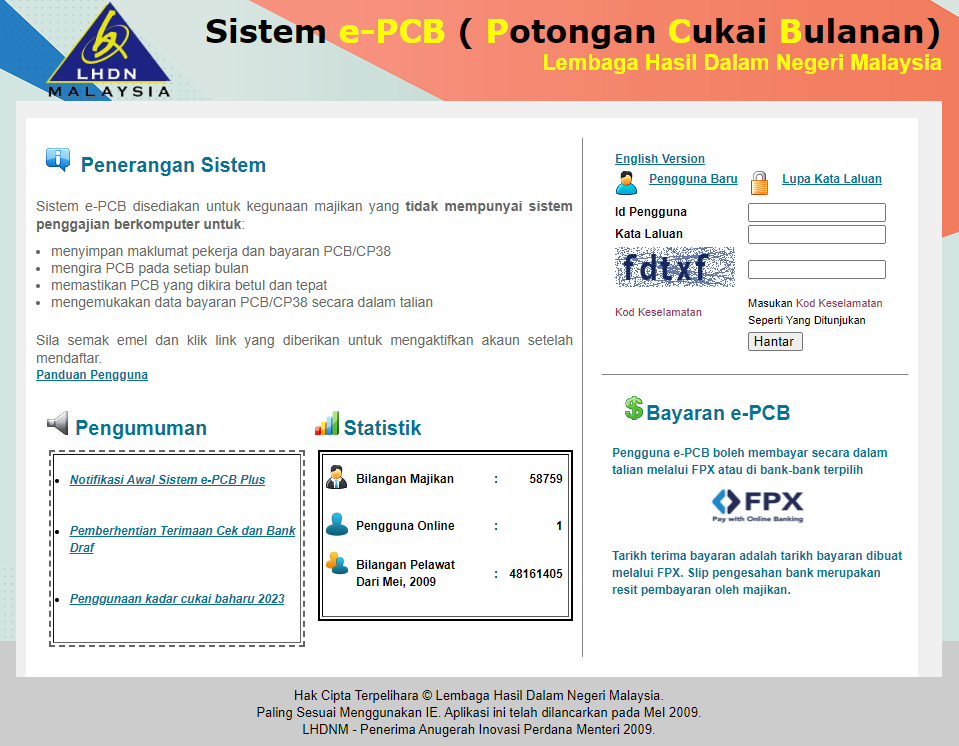

e-PCB System

Employers without computerized payroll systems can calculate and administer PCB with the help of the web-based e-PCB system. Important features include monthly PCB computations.

- online PCB payment data submission,

- employee information and

- PCB/CP38 payments storage.

e-CP39 System

Payments and PCB data submission are made online by registered users of the e-CP39 system. Access to the system requires registration of an ID and password.

e-Data PCB System

Companies can post CP39 text files online using the e-Data PCB system. Easy PCB data management is made possible by this technology, which guarantees data submitted complies with predetermined forms.

Current Payment Methods

Payroll options available to employers include:

- FPX (Financial Process Exchange) Payments made using ezHASIL, the official LHDNM portal.

- Internet Banking: CIMB Bank and other banks can be accessed via IBG/RENTAS/Telegraphic Transfer/Direct Cash Transfer services.

- Bank Counters and ATMs: A few chosen bank counters and ATMs allow payments.

Differences Between e-PCB, e-CP39, and e-Data PCB

- e-PCB: Employers without computerized payroll systems can use e-PCB. Enables PCB calculations, employee data storage, and PCB data submission online.

- e-Data PCB: For companies using computerized payroll systems, there is the e-Data PCB. Enables data format conformance and allows CP39 text file uploading.

- e-CP39: Enables registered and non-registered users to compute PCB amounts and make payments; designed for employers without computerized payroll systems.

Who Should Use e-PCB and e-CP39?

Every income received in Malaysia, whether from work or self-employment, is liable to taxes. As things are, anyone making RM34,000 a year (after EPF deductions) has to file an income tax return.

Companies without computerized payroll systems who used to submit paper forms and pay PCBs at LHDN payment centers should switch to the online e-PCB and e-CP39 systems. Accessible from anywhere, these tools enable a more effective and well-organized tax management procedure.

Filing Individual Income Tax Online

To those who are qualified to pay income tax, knowing the filing deadlines is crucial:

- Without business income: by April 30th of each year at the latest.

- With business income: by June 30th of each year.

Information Needed

Income Tax Reference Number: SGXXXXXXX e-Filing PIN

These can be picked up at the closest LHDN office. MySyarikat is another tool at your disposal to help with filing.

Importance of Accurate Tax Filing

On time and accurate tax filing guarantees that taxpayers carry out their responsibilities honestly and promotes national growth. Contributions from income tax are essential to the financial stability of the country and to the support of the underprivileged.

Prepare for the e-PCB Plus Transition with Kakitangan.com

As the Income Tax Department is preparing to introduce the new e-PCB Plus System, make sure your company is prepared for a smooth transition. Kakitangan provides cutting edge HR software solutions made to make managing your taxes and payroll easier.

Why Choose Kakitangan?

- Exceptionally Safe and Compliant with Regulation: Keep up with changes in regulations and stick to our safe system.

- Completely Automated: Payroll management and HR activities done automatically save time and lower errors.

- Premium On-Call Support: Throughout this time of changeover, our committed support staff is available to help you with any queries or problems.

Get Going Right Now!

Check if your company is ready for the e-PCB Plus System. You can concentrate on what is important with Kakitangan.com your business. Read more on How to Pay PCB: A Step-by-Step Guide (kakitangan.com)