In PCB calculation, there are 2 ways to calculate it, formula-based and table-based calculation. The latest table-based calculation was released by LHDN in 2018. Since then, LHDN has updated the formula-based calculation a few times but the table-based calculation has remained the same.

However, after the formula-based calculation has changed a few times in these few years, the 2018 table-based calculation needs an overhaul update. There are 2 approaches we could do. We may give up table-based base in our payroll calculator (most of other payroll software did that), or we may try to reengineer the table base to fit to the latest formula-based calculation.

Considering that we still have a number of companies using table-based calculation due to the convenience, we did some calculations with the latest formula-based calculation and reengineered the table-based calculation according to the 2024 format.

It took us some time, but we have just released it. The March's PCB calculation may (or may not, depending on the amount) be different from Feb amount - but it is more similar/closer to the actual 2024 formula base.

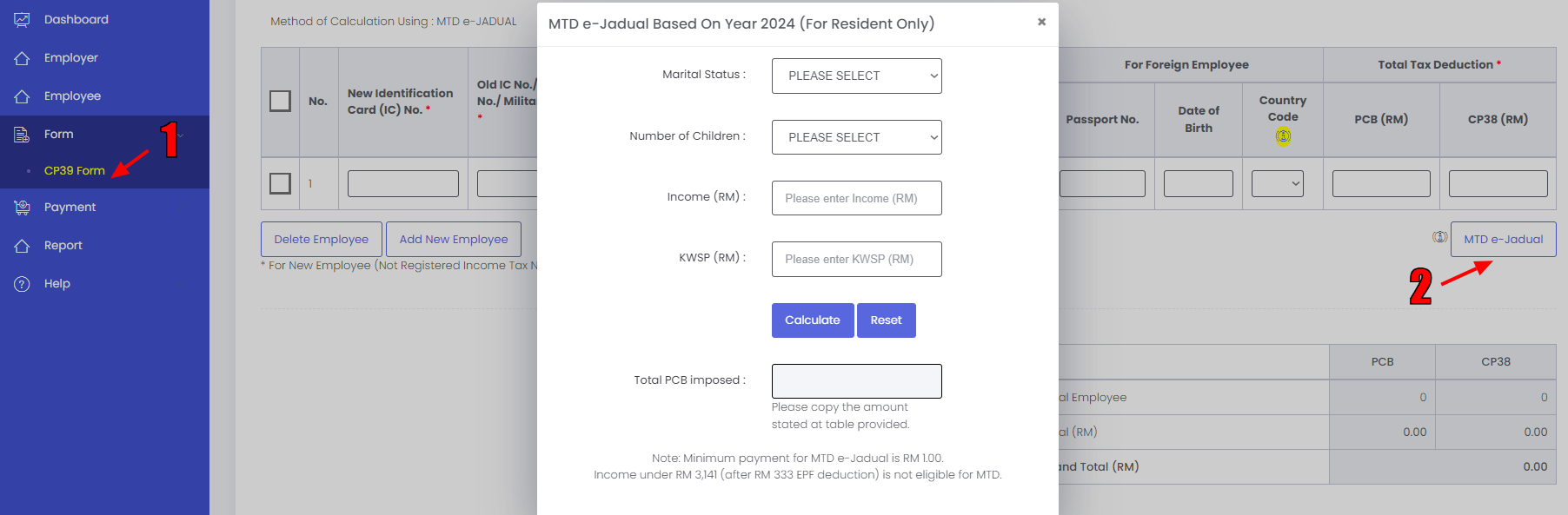

If you would like to verify the PCB amount, you may do so at https://ecp39.hasil.gov.my/home and register with your Employer Reference no. After logging in, go to Form > CP39 Form > MTD e-Jadual and fill up the information in the pop-up box:

As a company, you have 2 choices, you can continue to use the table-based calculation, where any differences from formula calculation should be minor, and your employees will have the accurate amount in next year's tax assessment; OR you may change to formula-based calculation as LHDN has only been releasing the updates for formula-based calculation for these past 3 years. We anticipate it will be the same in future.

What is the difference between formula-based calculation or table-based calculation, from a SME HR perspective? – In general, table-based calculation normally is the same from month to month if the parameters are not changing, BUT formula calculation may change due to the formula factoring in numbers from previous months and assumptions made for the future months. To get the formula-based calculation right, a new staff joining the company in the middle of the year, you also need to input TP3 amount (earlier months payroll aggregated amount when he/she was in previous company) into the system.

Yea - that's why it's easier to do table-based calculation and a lot of SMEs are still using it. Normally it's ok even if there are some slight differences with formula-based calculation because LHDN cares more about if you are practicing to pay PCB accordingly, and any differences from LHDN to the employees - it will be dealt in the tax assessment submission next year accordingly.

If you need any clarification, please feel free to reach out to the support team via support@kakitangan.com or livechat.