To access e-PCB Plus or submit your CP22 or E forms, you must possess either an Employer or Employer Representative role. Below, you will find a detailed step-by-step guide on how to apply for an employer role or appoint an employer representative in MyTax.

Submitting your application for the Employer role

For Company director / organization administrator

A company director must apply for the Director role through their MyTax account. The approval process can take up to 5 working days. Once the application is approved, the director will automatically receive the Employer role. So, here’s a step-by-step guide on how to achieve that,

- Go to https://mytax.hasil.gov.my/ and log in to your account.

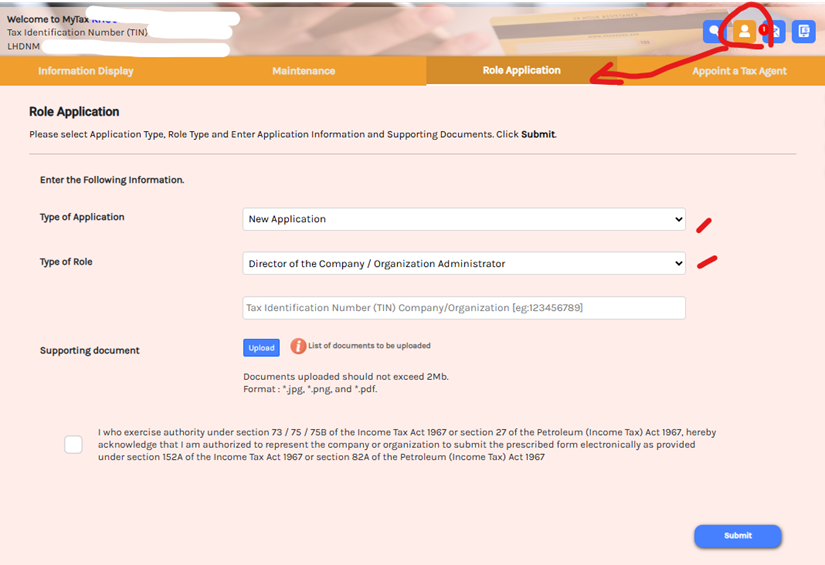

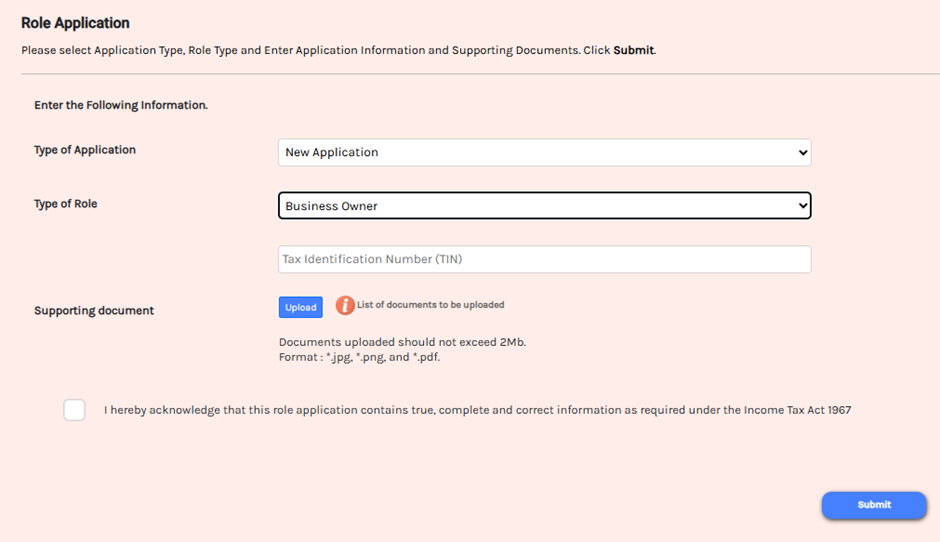

2. Click on the profile icon at the top right. Go to the third tab labelled ‘Role Application’. Set ‘Type of Application’ as ‘New Application’.

- Careful they are asking TIN (C number) not nombor majikan (E number)

- Can try upload form 49 (can include form 9 too) as a proof of company director

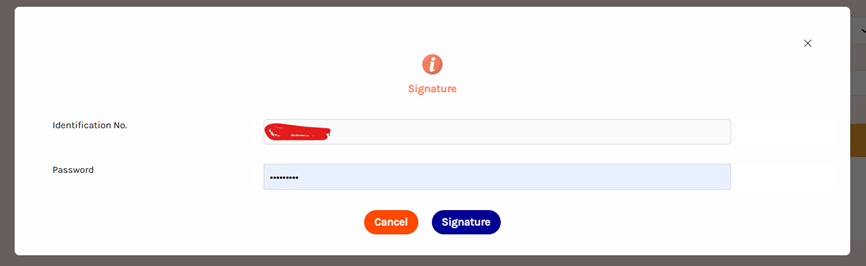

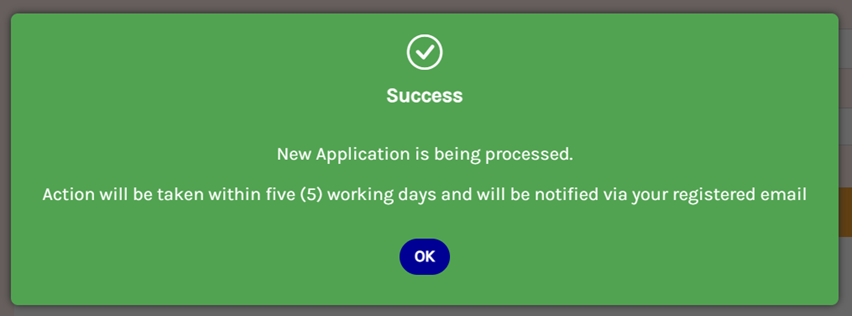

- They will ask you sign and give you a notification as screenshot. It takes up to 5 days for LHDN to approve.

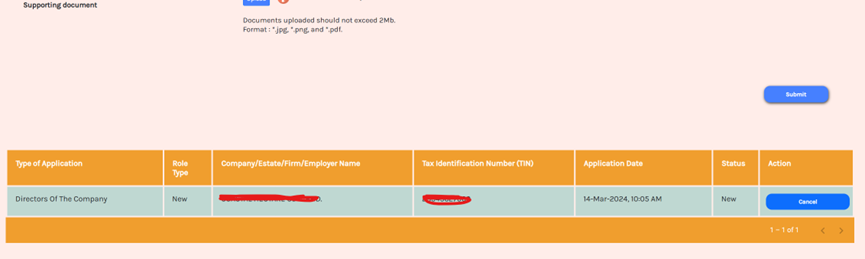

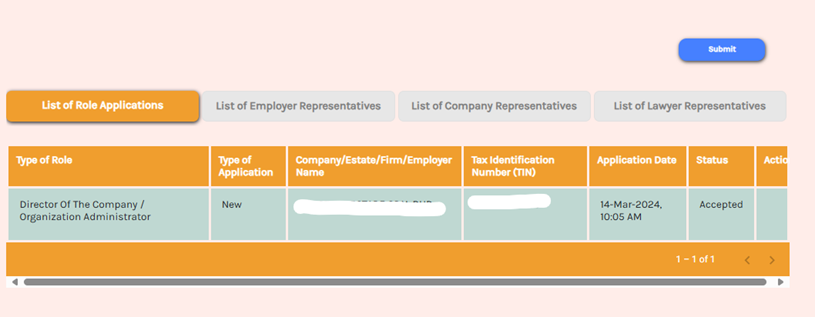

You may find the submission record in the table below,

Once approved, it looks like this

For Sole Proprietors and Partners

The process is similar to that of company directors. The copy of business registration certificate (or copy of IC for sole proprietors without a business registration certificate) should be uploaded.

Choosing Your Employer Representative

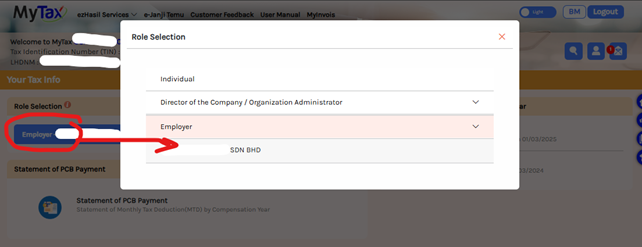

Person with employer rights/role, change role to select employer, choose the company.

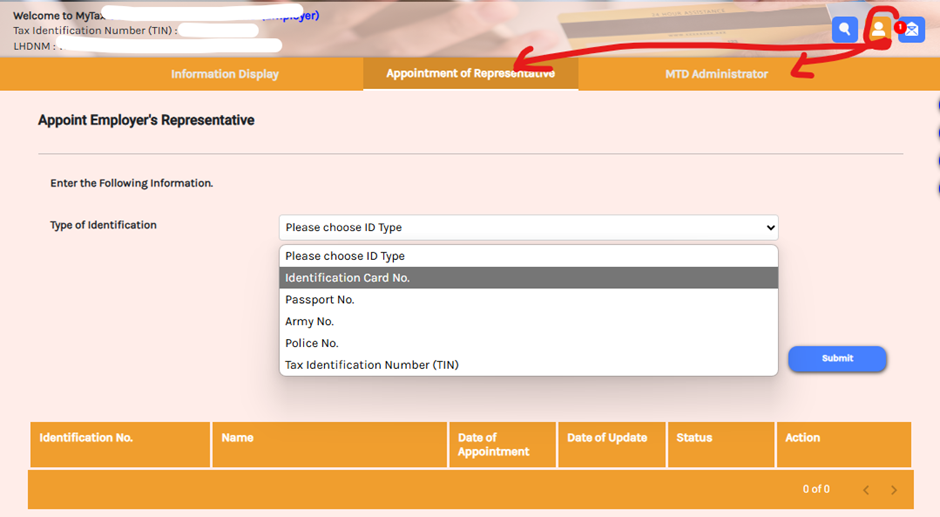

You can then appoint a representative or monthly tax deduction (MTD) admin accordingly so they can upload the PCB bulk data to e-PCB Plus.

Hope it helps 😃