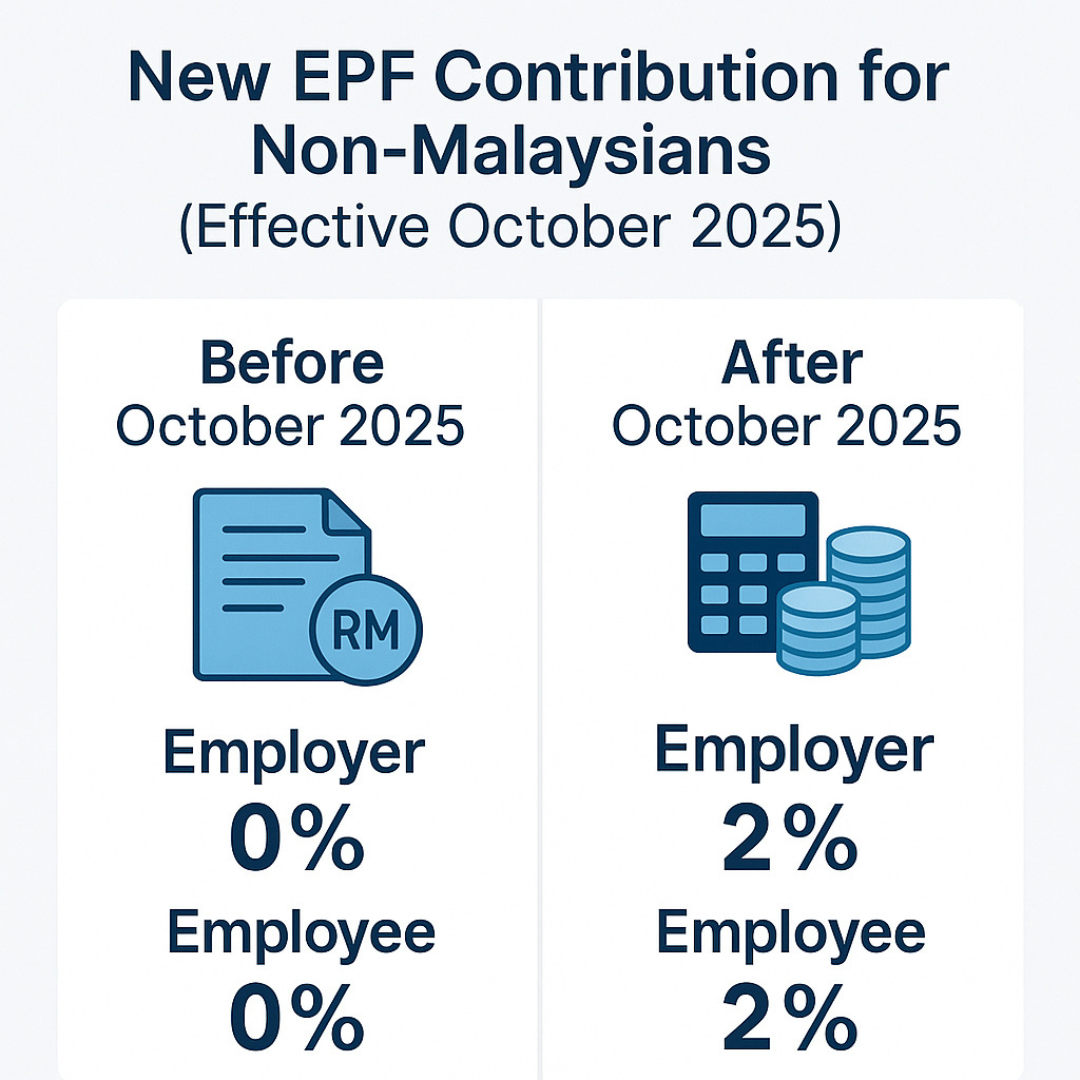

Effective October 2025: 2% EPF Contribution for Non-Malaysian Employees Is Now Mandatory

Starting 1 October 2025, employers in Malaysia will be required to contribute 2% to the Employees Provident Fund (EPF) for each non-Malaysian employee under their payroll. At the same time, non-Malaysian employees will also contribute 2% of their monthly wages to EPF.

This update is part of the EPF Act 1991 (Amendment 2024) and aims to strengthen retirement savings and financial protection for foreign workers across all industries in Malaysia.

What’s Changing?

Previously, EPF contributions for non-Malaysian workers were optional unless voluntarily agreed upon. Under the new law, the contribution becomes mandatory for both employers and non-citizen employees, including:

- Foreign workers with valid work permits

- Expatriates

- non-Permanent residents

The total monthly contribution will be 4%, shared equally between employer and employee at 2% each.

Why This Matters

This amendment reflects the government’s commitment to ensuring better retirement protection for all workers, regardless of nationality. It also provides more structured savings for non-Malaysian employees who often have limited access to long-term financial planning tools while working in Malaysia.

However, this also means employers must update their payroll systems and processes before October 2025 to avoid non-compliance.

What Employers Should Prepare For

If you employ foreign workers, you will need to:

- Update payroll systems to include the new 2% contribution rules.

- Ensure accurate employee classification, clearly identifying non-Malaysian employees.

- Communicate the upcoming change to affected employees so they understand the new deduction on their payslip.

- Prepare for changes in payroll costs, especially if your organisation hires a large number of foreign workers.

Employers who fail to comply risk:

- Penalties or fines from EPF

- Backdated contribution claims

- Legal complications under the EPF Act

How Kakitangan.com Supports This Transition

Kakitangan.com’s payroll system has already been updated to support the 2% EPF rule for non-Malaysian employees. This means:

- Our system automatically calculates and applies the correct EPF contributions.

- Monthly EPF reports are generated with the correct figures for both Malaysian and non-Malaysian staff.

- HR teams can avoid manual errors and stay compliant effortlessly.

- Non-Malaysian staff will see clear breakdowns of EPF contributions in their payslips.

With Kakitangan.com, businesses don’t need to worry about tracking legal changes or adjusting spreadsheets. We handle the compliance so you can focus on running your business.

Final Reminder

The 2% EPF contribution for non-Malaysians begins October 2025. Now is the time to get ready. By preparing your payroll processes early and using a system that adapts automatically, you avoid last-minute issues and ensure your team stays compliant with Malaysian law.

Need help getting your payroll ready for the change?

Log in to your Kakitangan.com account or contact our support team to learn more about how we’re making this update easy for you.