EPF Contribution 101: Understanding EPF Voluntary Contributions and EPF Self Contribution Malaysia

In today's fast-paced world, financial security is more critical than ever. For Malaysians, the Employees Provident Fund (EPF) offers a robust foundation for a secure retirement. However, to truly maximize your savings, understanding and utilizing EPF voluntary contributions is key. This comprehensive guide explores the benefits, methods, and recent updates regarding voluntary contributions to EPF Malaysia, self-contributions, and more.

What is EPF Voluntary Contribution?

Voluntary contributions to the EPF Malaysia are additional payments made on top of the mandatory contributions by employers and employees. These contributions are designed to help individuals boost their retirement savings. Whether you are self-employed, working in the gig economy, or simply looking to enhance your retirement fund, voluntary contributions can be a valuable tool.

Benefits of EPF Voluntary Contributions

- Enhanced Retirement Savings: Voluntary contributions significantly increase your total retirement savings, providing greater financial security in your later years.

- Government Incentives: Schemes like i-Saraan offer a 15% government incentive on the total epf contributions per year, capped at RM500 annually.

- Flexibility: With recent changes, you can now contribute any amount at any time without a minimum requirement, making it easier to align epf contributions with your financial situation.

- Tax Relief: Voluntary contributions are eligible for tax relief, reducing your taxable income.

- Annual Dividends: Contributions earn annual dividends, ensuring your savings grow over time.

Different Models of EPF Voluntary Contributions

In Malaysia, the Employees Provident Fund (EPF) offers various models for voluntary contributions aimed at enhancing retirement savings. These models cater to different segments of the population, including the self-employed, housewives, and those who want to top up their loved ones' savings. Here’s an overview of the main EPF voluntary contribution schemes:

1. i-Saraan

The i-Saraan scheme is designed for self-employed individuals and those without a fixed income. Participants can voluntarily contribute to their EPF Malaysia and receive a government incentive of 15% of the total epf contributions per year, capped at RM500 annually. This scheme also offers benefits such as tax relief and death benefits. To be eligible, one must be a Malaysian citizen, below 60 years old, and not have an employer.

2. i-Suri

The i-Suri scheme targets housewives registered under the National Poverty Data Bank (eKasih). This scheme allows housewives to save a portion of any income or allowance they receive. The government matches 50% of every RM1 contributed, capped at RM300 annually. Benefits include tax relief and death benefits. Eligibility criteria include being a Malaysian citizen, below 55 years old, and a registered EPF Malaysia member.

3. Account-1 Top-Up Savings

This scheme allows EPF Malaysia members to contribute to the EPF savings of their loved ones, such as parents, spouses, or children. Epf contributions can be made by any registered EPF Malaysia member below 55 years old. The recipient can be either a member or non-member, but must fill out the necessary form to start receiving contributions.

4. Akaun Persaraan Top-Up Savings Contribution

The Akaun Persaraan Top-Up Savings Contribution enables members to voluntarily contribute up to RM100,000 per year to their retirement savings. This scheme is beneficial for those looking to significantly boost their EPF savings beyond the mandatory contributions. Payments can be made through various channels, including cash, cheque, and online banking.

How to Make EPF Voluntary Contributions

1. Via i-Akaun

The i-Akaun is an EPF online platform provided by EPF Malaysia that allows members to manage their accounts and make voluntary contributions easily. Here’s how you can contribute:

- Register or Log In: If you don't already have an i-Akaun, you can register for one on the EPF website.

- Add Contribution: Select the 'Add Contribution' option, enter the amount, and follow the FPX payment process. Contributions are processed within three working days.

2. Bank Transfers

Many Malaysian banks offer EPF as a payee option within their online banking platforms. Look for EPF under the 'Payments' or 'Bills' section, and fill in your EPF number to make the transfer.

3. Bank Agents

You can also make epf contributions at designated bank agents such as Bank Simpanan Nasional (BSN), Maybank, Public Bank, and RHB Bank. Fill in the self-contribution form and submit it along with your payment.

4. EPF Counters

EPF offices nationwide accept voluntary contributions. Payments can be made via cash (up to RM500), debit cards, cheques, bank drafts, money orders, and postal orders. Ensure you include the self-contribution form with your deposit.

Understanding EPF Self Contribution

Self-contribution is another form of voluntary contribution, specifically designed for individuals who do not have regular employer contributions, such as the self-employed and gig workers. This scheme allows for flexible and regular epf contributions to build a substantial retirement fund over time.

Eligibility for Self Contribution

- Malaysian Citizen: Self-contribution is open to all Malaysian citizens who are registered EPF Malaysia members.

- Age Limit: Contributors must be below 60 years old.

- No Minimum Amount: As of July 2024, there is no minimum epf contribution amount, allowing for greater flexibility.

Contribution Limits and Distribution

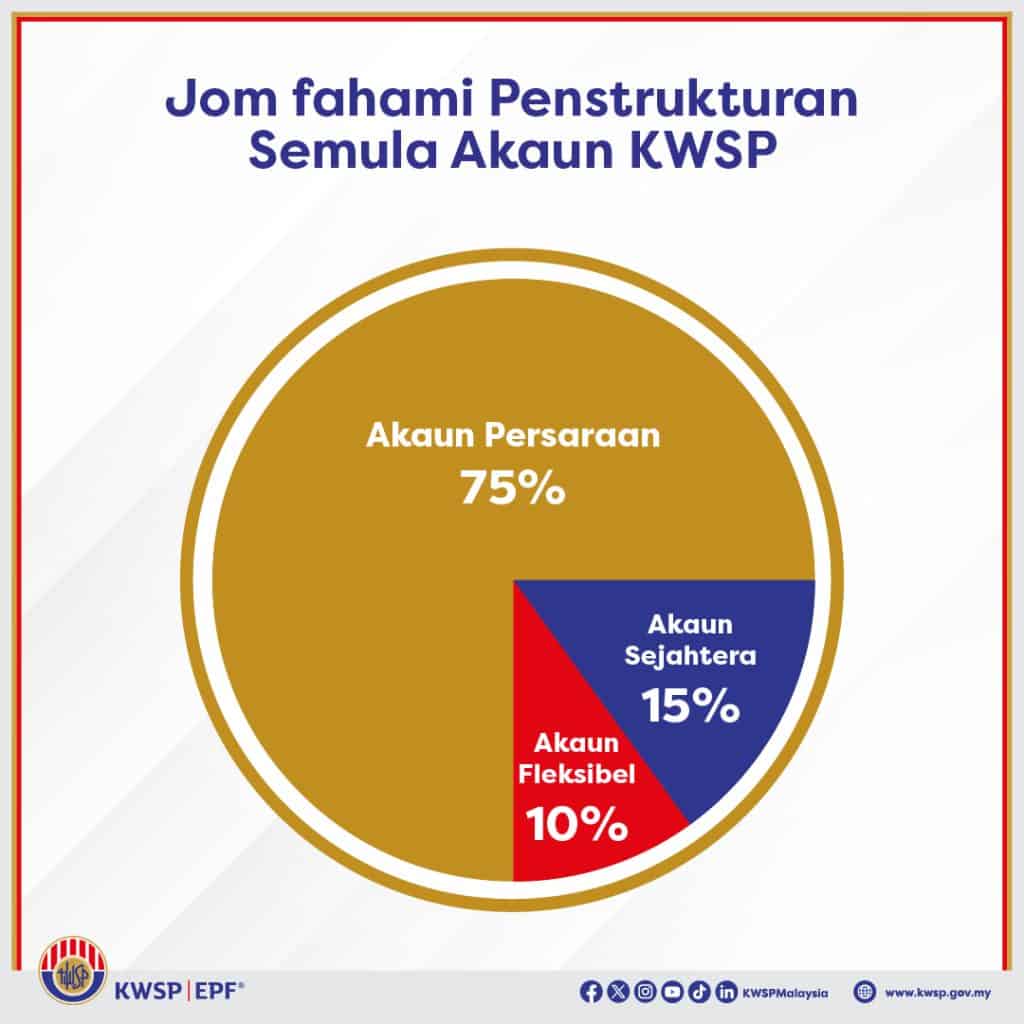

From May 2024, epf contributions (including self-contributions) are divided into three accounts:

- Akaun Persaraan (Retirement Account): 75% of contributions.

- Akaun Sejahtera (Well-being Account): 15% of contributions.

- Akaun Fleksibel (Flexible Account): 10% of contributions.

This new structure enhances the flexibility and utility of the savings, ensuring contributors have access to funds for various needs.

EPF Rate and Dividends

The EPF guarantees a minimum annual dividend of 2.5% for conventional savings. For those who opt for Simpanan Shariah, the dividend rate is based on the actual performance of Shariah-compliant investments. This ensures that your epf contributions not only grow but also stay aligned with ethical investment principles.

Maximizing Your Contributions

To make the most out of your EPF voluntary and self-contributions:

- Contribute Regularly: Set a schedule for regular epf contributions to steadily build your retirement fund.

- Utilize Tax Reliefs: Take advantage of tax reliefs to lower your taxable income while boosting your savings.

- Stay Informed: Keep up with the latest updates and schemes offered by EPF to maximize your benefits.

Maximizing Your HR Efficiency with Kakitangan.com

In the modern business landscape, managing human resources efficiently is crucial for the success and growth of any organization. Kakitangan.com is an all-in-one HR software platform designed to streamline HR processes for businesses in Malaysia. This comprehensive solution offers various tools and features that can significantly enhance your HR management, making it easier to handle payroll, payslip generation, leave, attendance, and more.

Features and Benefits of Kakitangan.com

1. Comprehensive Payroll Management

Kakitangan.com provides a comprehensive E Payroll system that simplifies the payroll process. This feature ensures accurate and timely payroll management, integrating seamlessly with all major banks in Malaysia and various accounting software. It also ensures compliance with regulatory updates, providing a secure and efficient payroll solution. Employers can generate accurate payslips for their employees, ensuring that every detail from salaries to deductions is transparent and precise.

2. Efficient Leave Management

The E Leave system allows for effortless management of employee leave. This cloud-based module enables employees to apply for leave and managers to approve requests with ease. The system offers real-time updates and integrates with payroll to ensure accurate leave calculations and balances. With features like automated notifications and a centralized calendar, managing leave has never been simpler.

3. Digital Claim Management

The E Claim system digitizes the process of handling employee expense claims. Employees can upload receipts and categorize their claims directly through the mobile-friendly platform, while managers can approve or reject claims with a single click. This feature reduces paperwork and streamlines the approval process, ensuring all claims are processed efficiently and accurately reflected in the payroll.

4. Real-Time Attendance Tracking

Kakitangan.com also offers a robust E Attendance system, known as Hadir, which simplifies daily attendance tracking. This system provides real-time access to attendance records and ensures that shift schedules and attendance are accurately reflected in the payroll. The automated approval process saves time and minimizes errors, allowing for seamless integration with payslip generation.

5. Integrated HR Solutions

Kakitangan.com integrates various HR functions into a single platform, including employee information management, benefits administration, and document storage. This integration allows for seamless HR operations and ensures that all employee-related data is easily accessible and securely stored.

How Kakitangan.com Can Help Your Business

Kakitangan.com is designed to cater to businesses of all sizes, providing scalable solutions that grow with your organization. Here are some ways Kakitangan.com can benefit your business:

- Time Savings: By automating and digitizing HR processes, Kakitangan.com saves significant time that can be redirected towards core business activities.

- Cost Efficiency: The platform reduces the need for extensive HR personnel and minimizes errors, thereby lowering operational costs.

- Regulatory Compliance: Regular updates ensure compliance with local labor laws and regulations, reducing the risk of legal issues.

- Enhanced Security: Data security is a top priority, with bank-level encryption and compliance with Personal Data Protection Act (PDPA) standards.

- Improved Employee Satisfaction: Easy access to HR services and transparent processes enhance employee satisfaction and engagement.

For more detailed information about Kakitangan.com and how it can transform your HR solutions effectively: https://www.kakitangan.com/

Learn More With Kakitangan.com

EPF voluntary and self-contributions provide an excellent opportunity for Malaysians to enhance their retirement savings. With the flexibility to contribute any amount at any time, coupled with government incentives and tax reliefs, these contributions are an effective way to secure your financial future.

We provide monthly online training just for you! This month, we bring in EPF and LHDN officers on July 10, 2024, where you can ask any contributions questions, including matters on self contribution mentioned above.

Register here: https://www.kakitangan.com/resources/trainings/penggajian-101/2024/july

For more resources, visit:

- What is the EPF? How to calculate? (https://blog.kakitangan.com/what-is-the-epf-how-to-calculate/)

- How to pay EPF online (https://blog.kakitangan.com/how-to-pay-epf-online/)

Contact us at sales@kakitangan.com for assistance or inquiries.