If you are preparing EA/E form, don't fret! It’s not difficult, and most of it are similar to last year, except the LHDN portal UI has changed a bit. Let us go through it with you step by step. [Updated as of Jan 2025]

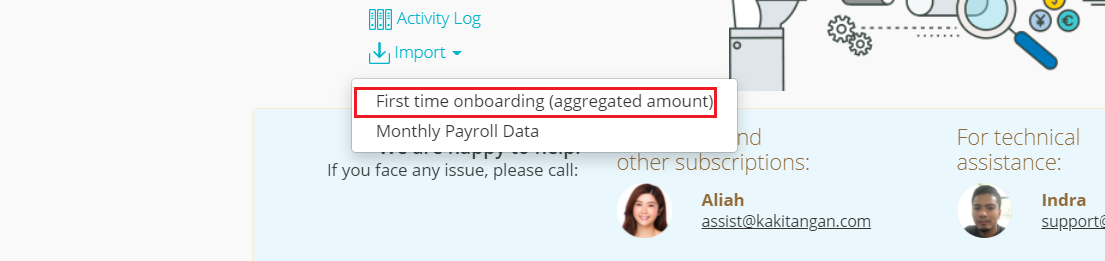

- Firstly, you need to get everyone’s aggregated 2024 payroll data correct. In Kakitangan.com, the system captures the data for form E/EA via 2 places: firstly, the payroll summary you “confirm” every month; and secondly, the payroll->import page that you put in aggregated numbers for your employee PRIOR TO using Kakitangan.com.

For example, If you start using Kakitangan.com in Nov 2024, so you have Nov-Dec 2024 in the Kakitangan.com payroll. But EA form should cover your staff compensation from Jan to Oct 2024. You fill in the aggregated amount of those in Payroll->Import. If you are using Kakitangan.com before 2024? Ah congratulation –you probably do not need to do the aggregated amount thing at all.

2. So, you double check everyone’s 2024 EA form. If they all have no problem, then your form E should be correct too. (hence "slightly faster way" some people do is opposite, to check the E form page and verify things are ok in a bird eye view, then spot check a couple of EA form.). If there’s any issues, here’s a specific case study on how you fix it:

There’re 2 months I had an RM1000/month allowance but it was set as taxable. I spoke to my tax consultant and confirms that it should be tax-exempted (make sure your tax consultant gives you some black and white). How do I fix it?

As the amount of netpay and tax has been transacted, you need to be very careful in amending the payroll data. To avoid the mistake, instead of amending the payroll records, you go to payroll->import to make adjustment. i.e. for this person’s 2024 aggregated number, you can minus 2000 in the taxable allowance and add 2000 in the tax-exempted allowance there. Keep an offline record on why are you doing that (especially the tax consultant advisory) – in case if LHDN audits you and you forgot the reason. Now, 2024 EA form number of this person should have the numbers that you’re looking for.

If you’ve done the above correctly, you should have EA/E form numbers correct.

[Note: by 1 Mac, you may submit CP8D still, it is the same process as praisi. ]

- Now go to Payroll->Form E page, download the e-Data Praisi file and unzip it. Use the file start with P to submit. By 25 Feb 2025, you are encouraged by LHDN to submit the E-data Praisi. The website is https://ez.hasil.gov.my/ - we attach a few screenshots here to make your life easier.

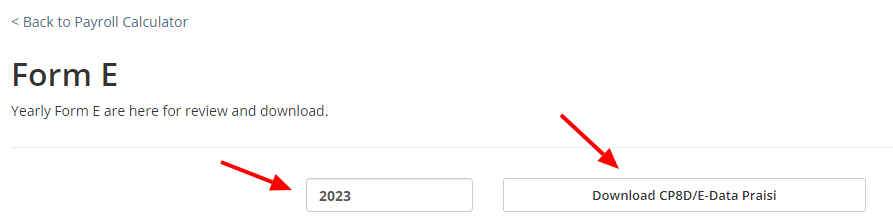

Go to payroll > Form E, select the previous year like 2024 and click "Download CP8D/E-data praisi".

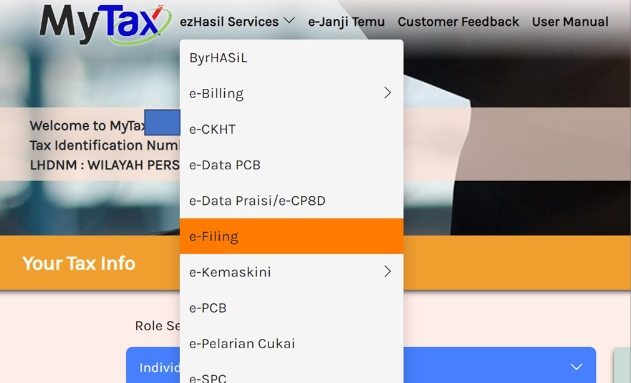

After that, go to the LHDN's website https://mytax.hasil.gov.my/

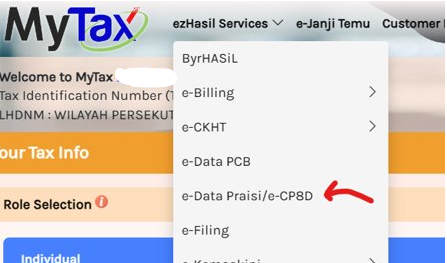

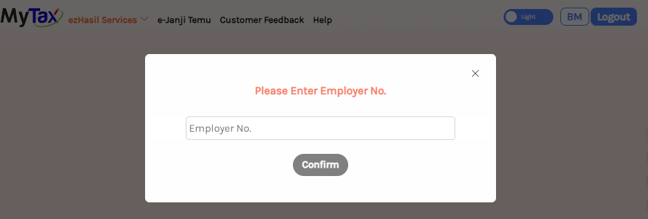

Login with one of the director IC will do, choose E-data Praisi and fill up the employer no.

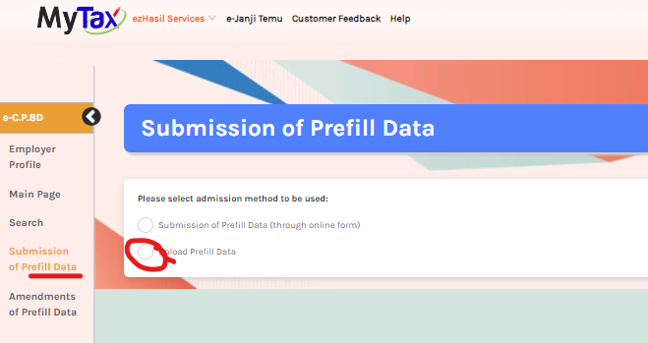

Under ezHasil Services, e-C.P.8D to Submission of Prefill Data to select Upload Prefill Data.

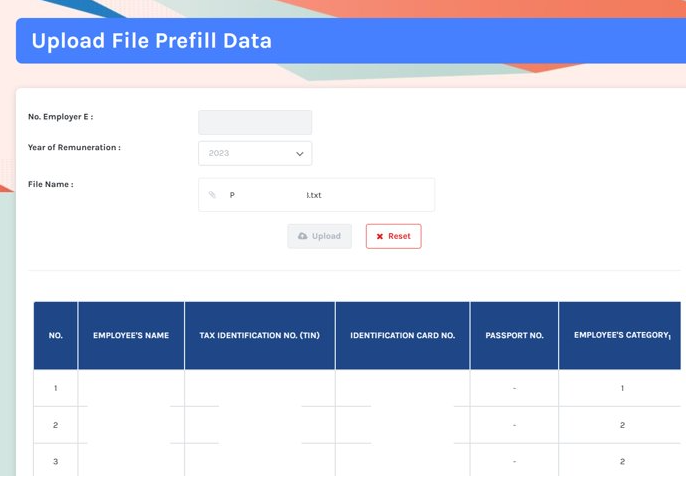

Unzip the file you get from kakitangan.com's form E page. Upload the txt file start with P. Then employees' details will be generated:

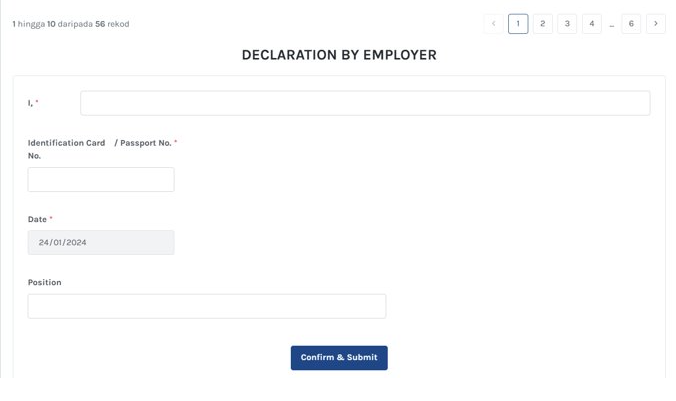

At the bottom, fill up the declaration

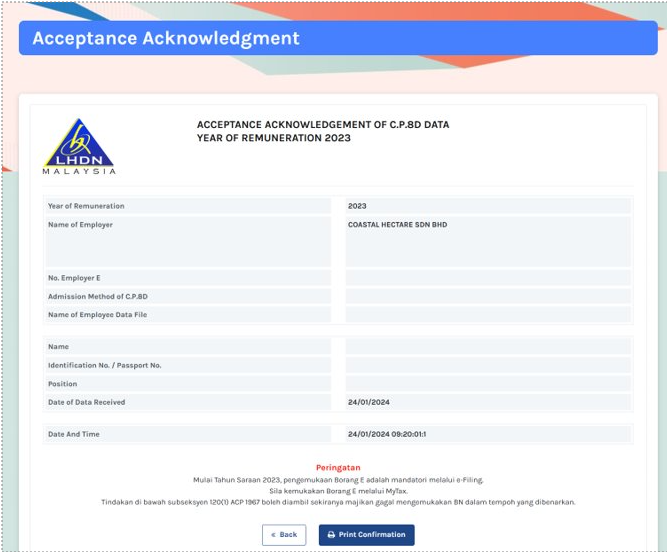

Then you got a confirmation for printing. Go ahead and print as pdf and save as record. Please check on LHDN portal again by 1st of March.

EA Form

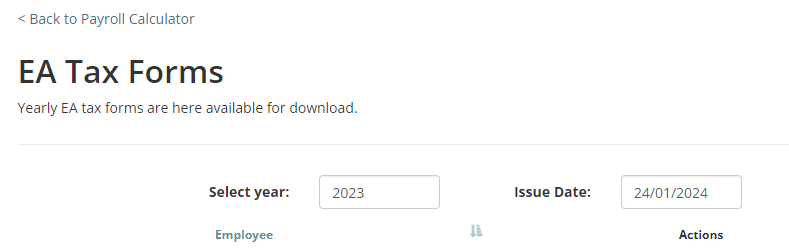

- You may now send EA form to your colleagues, by email or by print out the hardcopy. Do it in Feb so they can have their tax assessment in March.

- Kakitangan.com allows you to trigger email send to all your staff. If the staff has left the company, you may download the EA form and send to them outside of our system.

Form E (C.P.8D)

- CP8D is the file upload for Form E. The portal opens every year at 1 March.

- Location of portal: MyTax https://mytax.hasil.gov.my/

- Previously if you have not uploaded e-data praisi before, you may go ahead and upload CP8D now – it's faster, (check our e-data praisi/CP8D upload screenshots). Otherwise move forward.

- Then you can do form E submission now. The deadline is 31 March.

- After your form E has completed, let your staff know they can proceed with their BE/B assessment on their LHDN portal account. It should follow your form E data but they can edit (especially they have multiple form E from different companies). They deadline of doing so is 30 April.

- If you uploaded CP8D and completed form E process below, then realize there is an error, email CP8D@hasil.gov.my to ask them on your needed change. Remember put your e-majikan, company name and the requirement of change / updated CP8D.

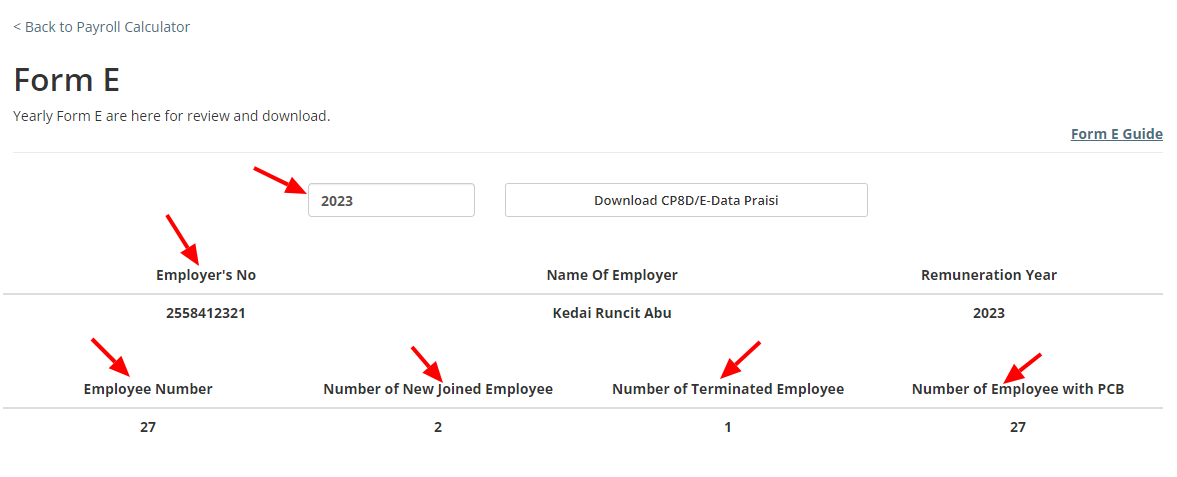

Get company data from Kakitangan.com

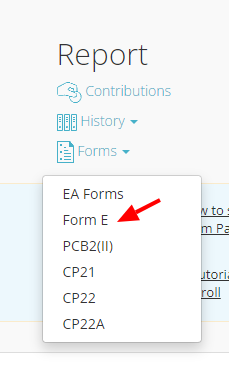

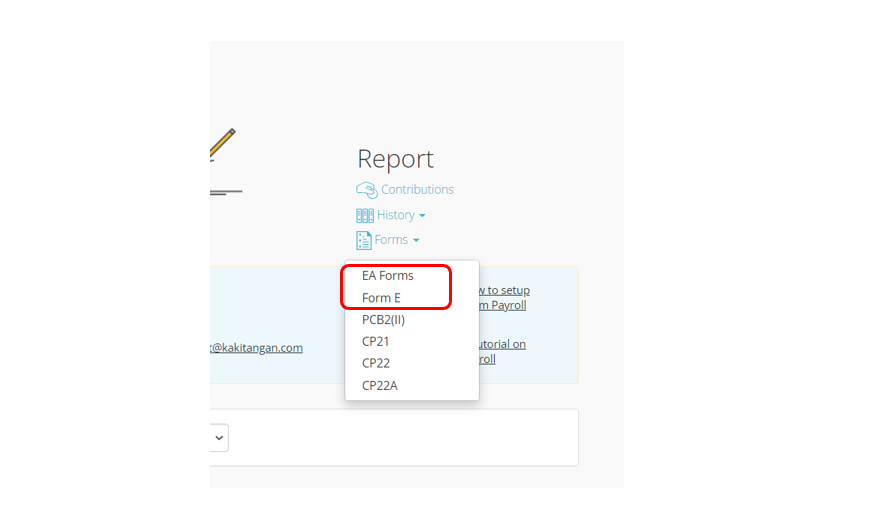

- Go Payroll -> Forms-> Form E

- Double check if the year is 2024 (the data year your want to submit)

- Later, you can copy some data here and paste to LHDN portal later

LHDN Website

After login into the new LHDN website https://mytax.hasil.gov.my/ , login with one of the director IC will do.

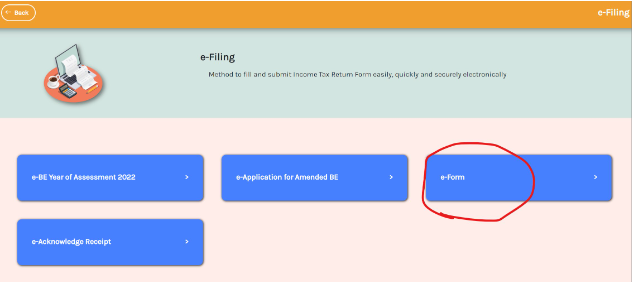

Choose Form E

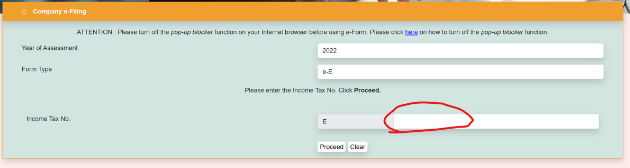

Choose 2024

Key in your company E number

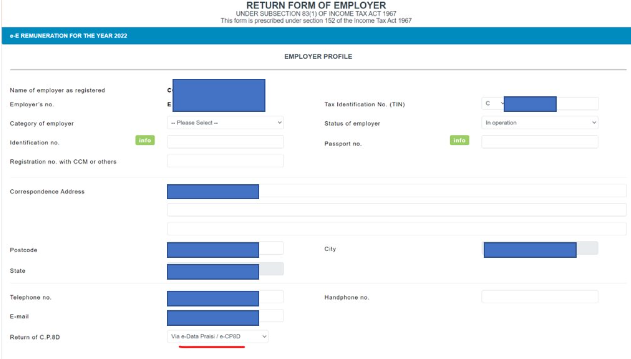

Fill up the necessary data (they should be filled up if you have done it in previous years), then select via e-data praisi/e-CP8D

Note that it's different from 2022 and before, it does not have the upload feature here now.

- If you have not uploaded the e-data praisi, do the e-data praisi / e-CP8D upload (see the e-data praisi screenshots above)

- If you have uploaded the e-data praisi BUT having amendment after that, redo the e-data praisi / e-CP8D upload again (see the e-data praisi screenshots above)

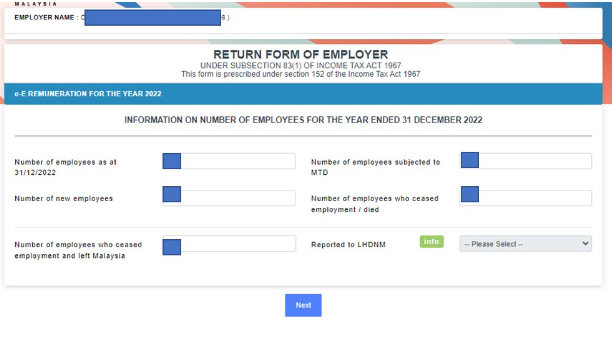

Fill up these data. You can get them from the form E page in Kakitangan.com

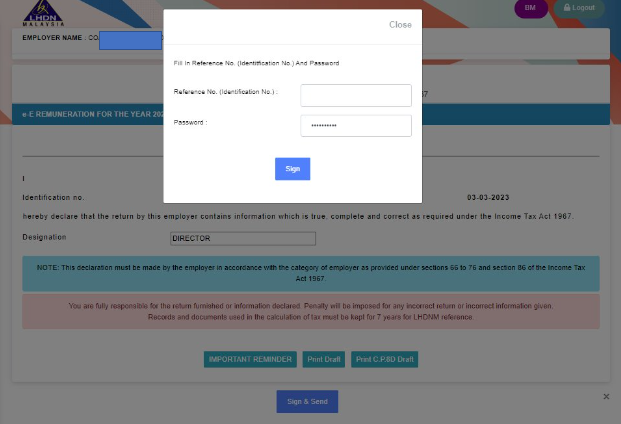

Sign it

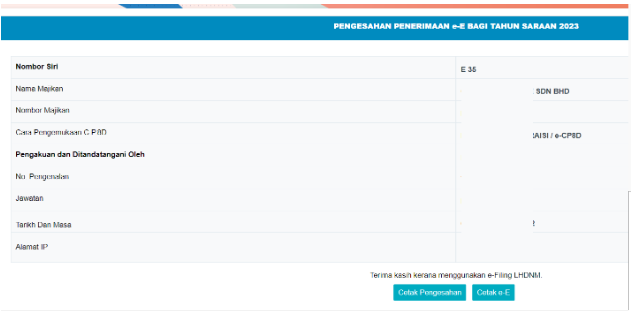

And save the 2 pdf files with button here as receipt and acknowledgement.

And you're done, congrats!

If there’s error in submission, it could be the data too long that breach the limit of fields. (say employee name too long?). You may open the text file and compare to their format description.

https://www.hasil.gov.my/media/fw2jk2fd/rf-filing-programme-for-the-year-2024.pdf

Hope it helps. Look forward to your successful submission to LHDN!

But wait... what if you have made submission then only realized you did a mistake? Ok we got you cover on that too!

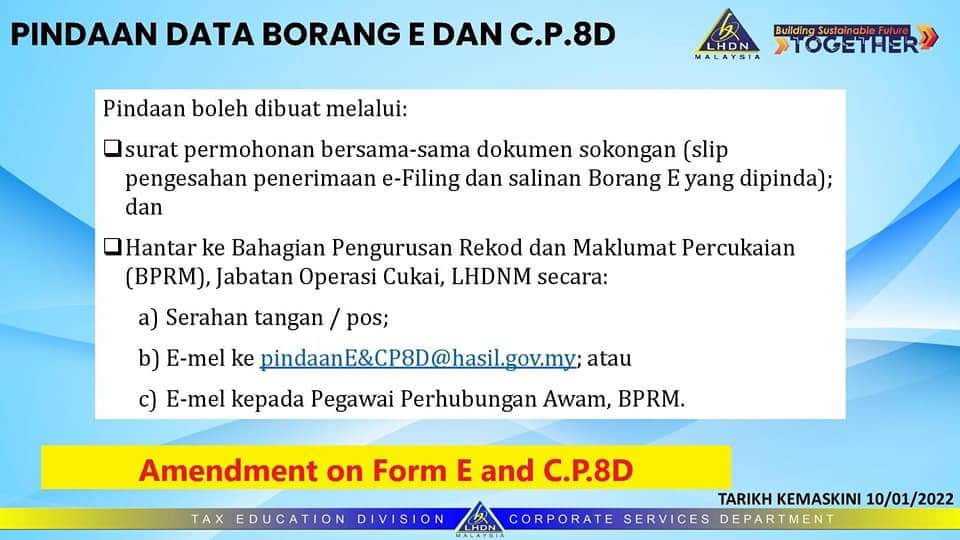

Basically there are ways to send in your application of amendments:

Step 1: Prepare an application letter for amendments with supporting documents (the earlier acknowledgement on e-filing submission and amended Form E)

Step 2: Send the Record Management & Tax Information Department (in Malay will be Bahagian Pengurusan Rekod dan Maklumat Percukaian, in short BPRM).

You may send via:

a) By hand/post;

b) email to pindaanE&CP8D@hasil.gov.my; or

b) email to pindaanE&CP8D@hasil.gov.my cp8d@hasil.gov.my ; or

c) email to Public Relations officer of BPRM

For more details that you wish to know, may refer to their latest e-cp8d guideline here.

We wish you a smooth submission and all the best!