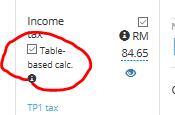

Should I use table-base or formula-base for the PCB calculation?

LHDN accepts both. So you choose either one, generate the tax file from Kakitangan.com and upload to the e-Data PCB website to pay.

Formula base try to optimize your payment, so you pay lesser during the year. The problem is during tax assessment, you may need to pay a bit back. And also every month number can be different - the formula is complicated so some HR finds it hard to explain to the staff. Besides, you need to import the previous month salary to get it right.

Table base max the payment of the month, so in theory you pay upfront. The good part is it is same every month, and it is easy to justify the amount in any audit. Also, employee feels good when they get some money back from tax assessment time.

With the above, you can see many SME HRs go for table base while bigger companies HR go for formula.

how to setup Kakitangan.com so you can automate the max for your payroll and people operation /onboarding-your-company-to-kakitangan-com-for-the-first-time/