All businesses operating in Malaysia are subject to local labour laws, designed to protect the rights of both the employer and the employee. Thus, employers need to be aware of things such as what is EIS, and how to calculate their EIS contribution.

Avoid unnecessary penalties by keeping yourself informed of your local labour laws. Continue reading to find out more about what is EIS and how to pay your EIS contribution.

What is EIS?

EIS stands for Employment Insurance System. In Malay, it is known as Sistem Insurans Pekerjaan, or SIP. The scheme was introduced in January 2018 and is managed by the governmental organisation, PERKESO, and is also known as SOCSO.

The scheme was set up to offer financial aid to employees who have lost their source of income. These retrenched employees would receive financial aid for up to 6 months, with the scheme being inclusive of job counselling and more.

With these savings, the goal is to ease the process of finding new employment and to serve as a source of financing until a new job is acquired. The fund requires for both employee and employer contributions.

Difference Between EIS and EPF

Like EIS, EPF is an employee funding scheme in Malaysia. EPF stands for the Employees Provident Fund, and is also widely known as the KWSP, or Kumpulan Wang Simpanan Pekerja.

EPF aims to provide financial support, but in the form of collecting and managing compulsory retirement funds. Like EIS, the EPF is important and governed by the law, but there are a few key differences between the two financing schemes.

Read More: What is EPF and How It Helps Your Post-Retirement Life

The most evident difference is the groups that they target, where EPF is catered for retirement, and EIS aims to support retrenched employees. Here are some of the notable differences between the two schemes:

|

EIS |

EPF |

|

Financing scheme geared

towards retrenched employees |

Savings collection scheme

geared towards retired employees |

|

Aims to provide support

during the process of job finding |

Aims to provide a source

of funding post-retirement |

|

Under PERKESO |

Under the Ministry of

Finance |

How to calculate EIS contributions?

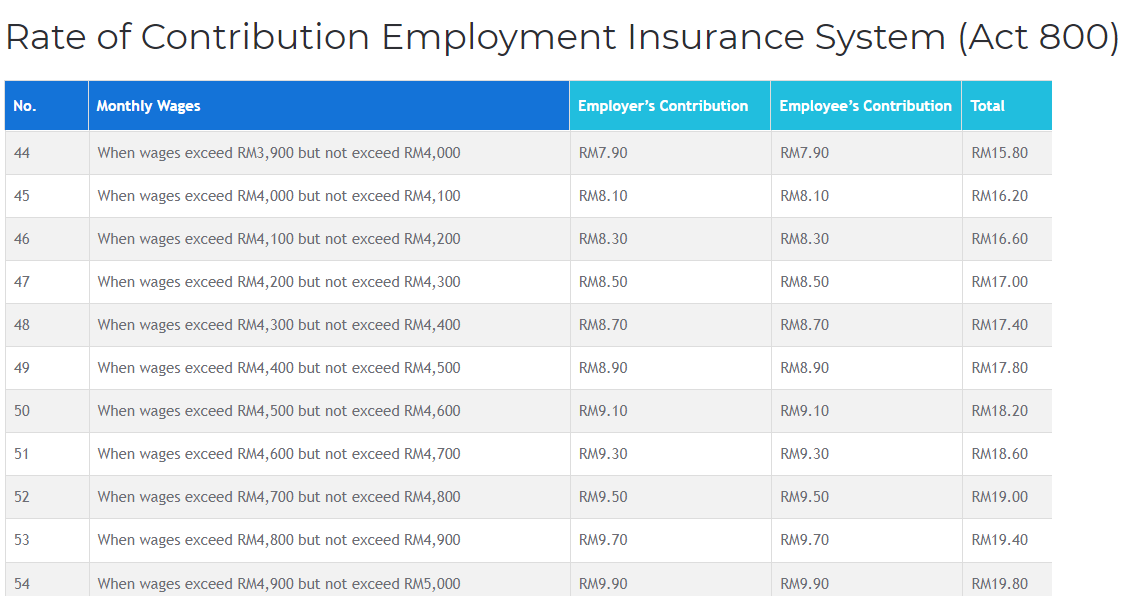

It is important to be aware of your EIS contributions, as the law requires both employee and employer to contribute. Both parties contribute 0.2% of the employee’s monthly salary, which gives the employee’s EIS a total of 0.4% of their salary a month.

The 0.2% contribution rate is catered towards employees aged 18-60. However, for employees aged 57 or more, and have not made contributions in the past, the EIS contribution rate does not apply.

As of the 1stof September 2022, contribution rates have been capped at an insured salary of RM5,000. For more information on EIS contributions, view the table below:

Other PERKESO Schemes

The EIS is an important financing scheme to ease the burden of retrenched employees. Alongside EIS, PERKESO has other schemes catered towards various situations and groups:

Employment Injury Scheme

- Aims to shield employees against occupational diseases and accidents due to and in the course of their employment.

Employment Injury Scheme for Foreign Workers

- Similarly, foreign workers also reap benefits, such as rehabilitation facilities, from the Employment Injury Scheme.

Invalidity Scheme

- The Invalidity Scheme covers employees who suffer from invalidity and death of any cause unrelated to their employment.

Self-Employed Social Security Scheme

- Catered towards individuals who are self-employed, the scheme shields insured individuals against employment injuries.

For more information on key topics, such as what is EIS, you can visit Kakitangan.com’s main blog or email us at sales@kakitangan.com. Our HR experts are at your service, and our blog contains many resources to keep both employers and employees informed.