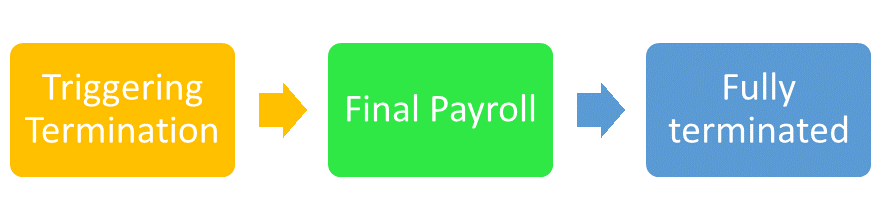

Employee termination can be a hassle especially when it comes to calculating the leave balance.

Kakitangan.com proudly presents you this new feature, not only we automate the pro-rata leave balance calculation but also send the balance amount directly to your payroll calculator.

Wonder how this magic works? Check them out with just a few steps below.

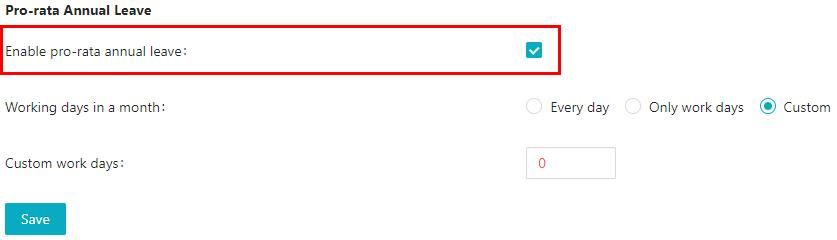

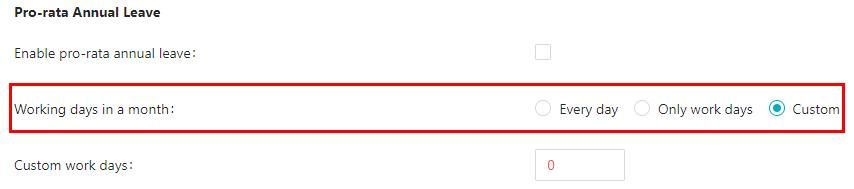

How to enable this feature?

Go to payroll settings -> Pro-rata Annual Leave -> Enable it

Note: If you are familiar with our pro rata salary then you will find the pro-rata leave balance works as the similar concept.

How your setup can affect the final calculation?

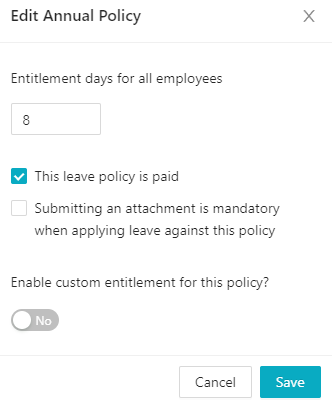

- Annual leave entitlement

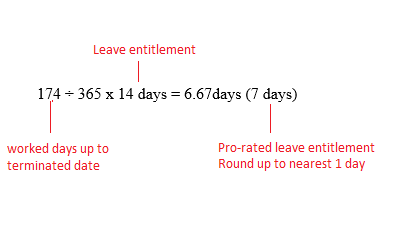

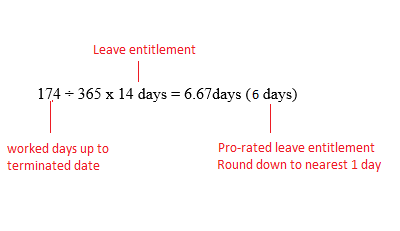

Annual leave entitlement days under leave setting will affect the pro-rata leave entitlement calculation.

2. Rounding for pro-rata leave

Your setting on rounding for pro-rata leave under leave setting will affect the pro-rata leave entitlement calculation.

- Round down

- Round up to the nearest: full or half day

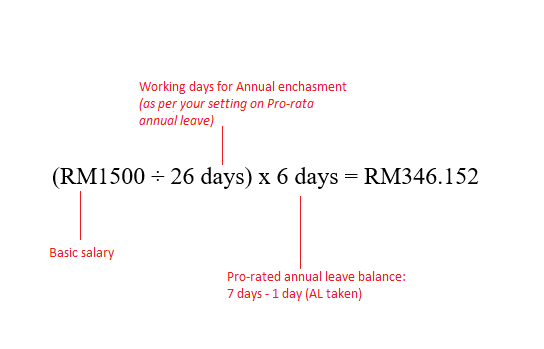

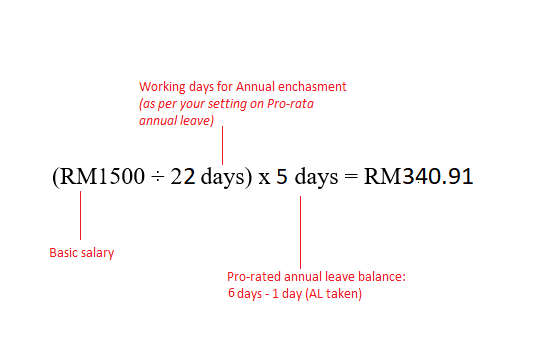

3. Working days for annual leave encashment

Determine the working days you would like to use for annual leave encashment calculation.

Note: Every company has a different method/policy when it comes to pro-rata annual leave, so it's up to you to determine the working days in a month here.

How does the calculation work?

Let's put the calculation into real scenarios for better understanding.

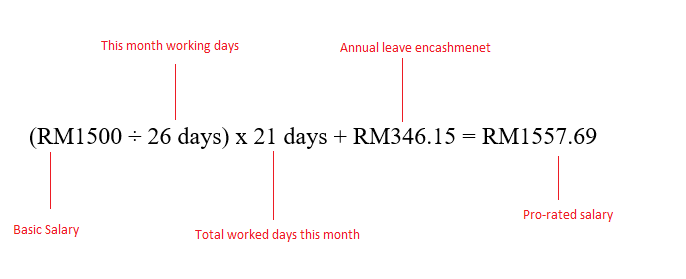

Scenario A: Amy's profile setting as below

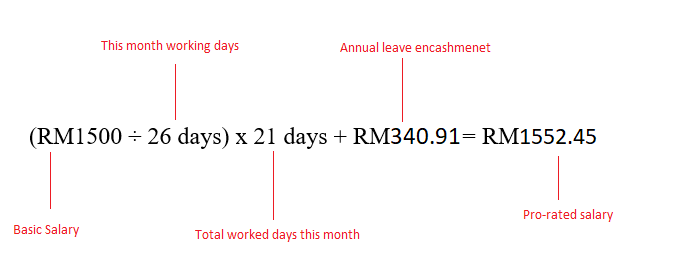

- Basic salary : RM1500

- Working days of this month: 26 days

- Actual worked days of this month: 21 days

- Termination date : 22 June, 2020

- Employment effective date : 01 May, 2020

- Annual leave entitlement (accrual) : 14 days

- AL taken: 1 day

- Pro-rata leave rounding: Round up to the nearest 1 day

- Working days for Annual encashment: 26 days

Scenario B: Amy's profile setting as below

- Basic salary : RM1500

- Working days of this month: 26 days

- Actual worked days of this month: 21 days

- Termination date : 22 June, 2020

- Employment effective date : 01 May, 2020

- Annual leave entitlement (full entitlement) : 14 days

- AL taken: 1 day

- Pro-rata leave rounding: Round down to the nearest 1 day

- Working days for Annual encashment: 22 days

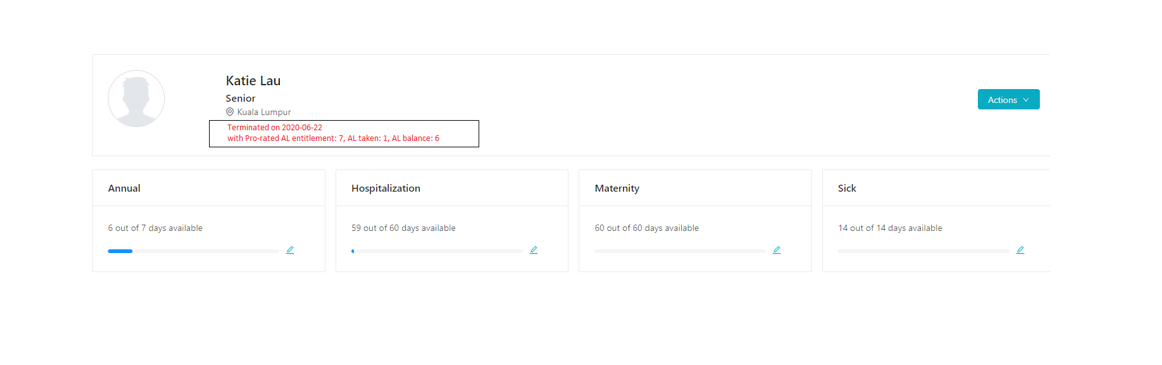

Where do I see the pro-rated leave balance and the leave encashment amount?

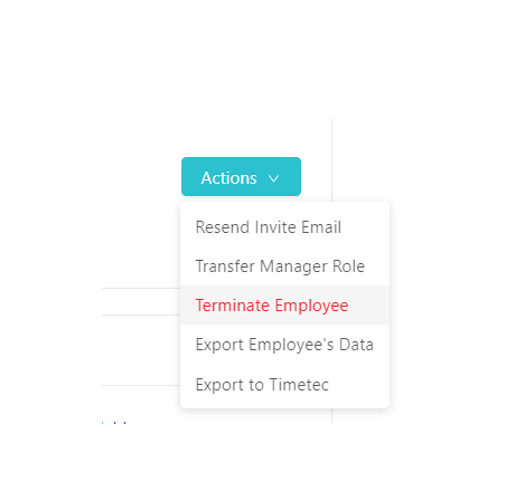

- On User profile -> Actions -> Terminate Employee -> Select termination date -> you will find the balance info under the employee's name

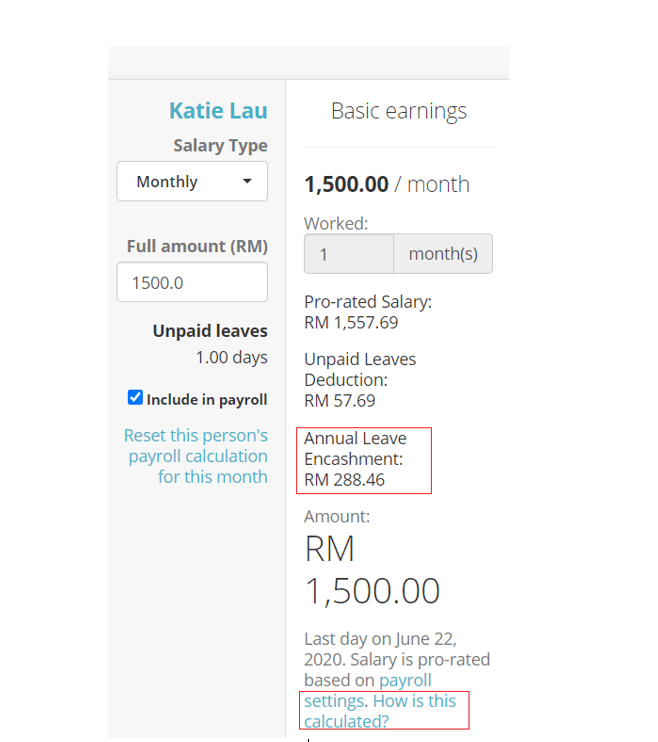

2. On Payroll ->under Payroll calculator -> Select terminated employee name -> Basic earnings -> you will find the annual leave encashment amount. To find out how to get that amount, click on How is this calculated?.

Tip: If you can't see what's showing below. You can un-check the "Include in payroll" box and re check it to make sure the page gets refreshed with the right figure.

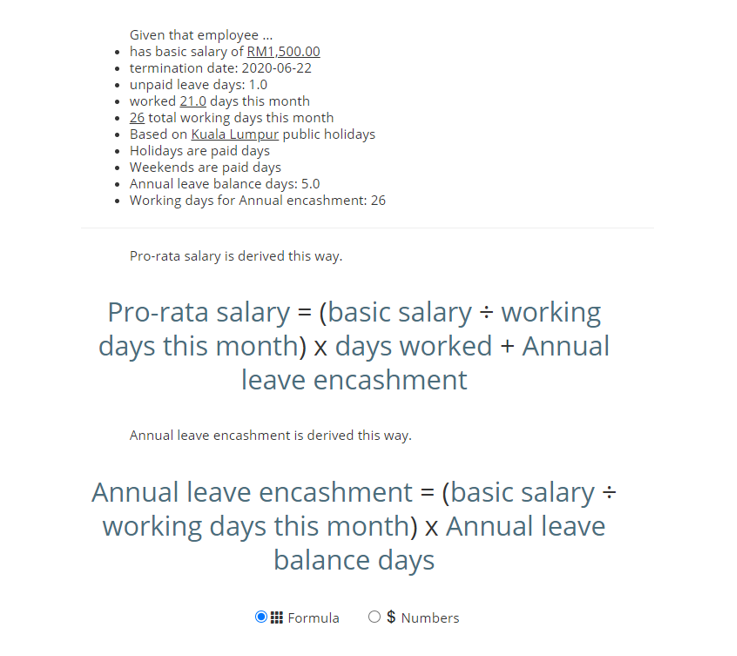

You will come to this screen with details about the terminated employee and how the annual leave encashment is being derived as well as the final pro-rated salary.

Quick tip: Options for users to select formula or numbers to understand how the calculation works.

Hope this feature helps! :)