Bank vs. Portal: The Best Way for SMEs to Pay Statutory Payments in Malaysia

For most SMEs, handling payroll transactions might not be a problem just yet. But as your company grows, you will start to face some issues on the transaction if you are not using the right payroll system or the know-how on basic payroll. If you are not yet aware, statutory payment mechanics has been a long-standing dilemma for SMEs. We have talked to many businesses over the years, we have identified the challenges and now we want to share our findings with you.

Should payments be made directly to the statutory bodies, or direct bank transfers? Let’s discuss.

What are the statutory payments you need to know?

Before we start, you first need to know there are 5 types of statutory payment:

1. EPF/ KWSP

2. SOCSO

3. EIS

4. PCB (LHDN)

5. HRDC

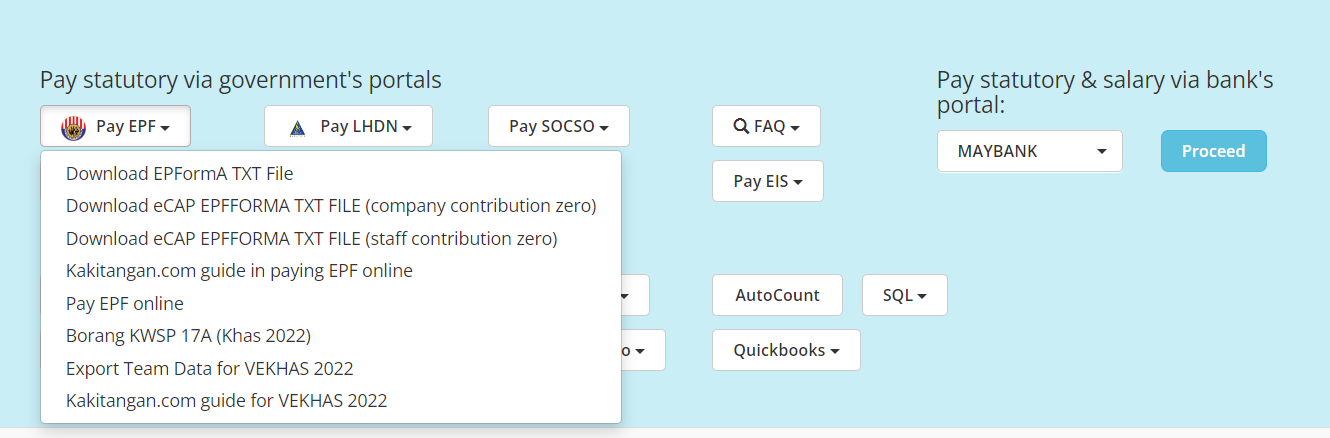

Kakitangan.com can assist you with calculations and offers a variety of payment channels. Additionally, our system provides a convenient drop-down list for you to select your preferred method.

However, please note for HRDC, employers need to visit the HRDC website to register and pay via JomPay. Don’t worry. Our system can still calculate it for you and all you need to do is to just refer to the amount and make the payment accordingly.

*Download our payroll guide HERE

Direct paying to statutory portals

Paying directly to the statutory bodies is typically recommended, as it ensures records are accurately recorded in their respective portals. This practice will make it easier for you during audits, as you will have clear proof of compliance. For those who are familiar with statutory portals, good for you. However, it’s important to start considering what will happen as your company grows. We suggest checking your bank transactions limit.

Are you aware of the bank transactions limit?

The dilemma arises when making payments through these statutory portals, as it may trigger FPX transactions back to your bank account. Different bank accounts have different FPX limits. For example, as of December 2023, Maybank2U Biz has a transaction limit of RM50K. If your payment exceeds this limit, such as with EPF contributions which usually will take more than that (depending on your company size), you'll need a bank account with a higher FPX limit. Alternatively, if supported by your bank, you can opt for bank statutory file uploads instead.

Good news for SMEs!

Kakitangan.com can support BOTH payment mechanisms! Be it uploading a file to the statutory website portal; or directly to the bank portal (please be reminded that every bank has its format), rest assured you are in good hands!

Our system is designed to cater not only for small businesses but also growing companies. We have done years of research and development to ensure that all businesses will no longer face this issue. We understand the pain, so we solved it. Keep an open mind and remove yourself from unnecessary issues of handling payroll today. If you need help using our system, we are ready to help.

Check out how our system can help you with statutory bodies payment. Try it out!

Read our other blog to know more about statutory applications:

How to open LHDN account for the first time